Opening an SMSF

So you’re thinking about opening a SMSF? Let me go through some of the things I considered before opening my SMSF, which you might consider too.

Is it right for you?

Firstly, think about your balance. There is a lot of talk about the need to have sufficient funds to make it worthwhile. This is very important. But also valid is the consideration ‘how much will I have in super in a couple of years’ time’?

If you are keen to take the Total SMSF route and are on the verge of a balance where you think it makes sense to go for Total SMSF, you should think about what could happen to your super balance over the next couple of years with some more investment earnings and regular contributions. It could be that in a year or so you will be over what you think to be a reasonable amount to have in an SMSF, in which case if you want to take control today maybe you should go ahead and to it.

Secondly, evaluate your reasons. For me it was twofold. To combine super with my wife so we are actively managing just one super account, and to give us future flexibility or what I call optionality. The first reason is reasonably straightforward, but let me expand on the second.

Flexibility

To be honest, when we are invested in a few weeks I doubt our portfolio will be any different to what we could create using Complete Super. But I like the flexibility of a SMSF. If we can afford to, one day we might put property or other investments in our SMSF and some of these investments cannot be made via Complete Super (which as an APRA-regulated fund has an investment committee, and a series of regulations restricting what members can invest in).

To move my super to Complete Super now, and Total SMSF in several years’ time would just be more paperwork, which I am happy to avoid. More importantly, moving super could involve having to realise capital gains as the tax office would treat a migration of funds from any APRA-regulated super fund to a SMSF as a realisation event – that share you purchased for $10 that is now worth $20 will be sold so you can take your money out of the APRA-regulated fund. This has tax consequences that must be considered.

A final point on flexibility is the transition to retirement. I am nowhere near retirement age, but as it stands the migration from accumulation phase to pension for the vast majority of people in APRA-regulated super funds is treated as a realisation event (again tax consequences) because you have to move your holdings to a new type of account. You don’t have to do this with an SMSF.

Setting up

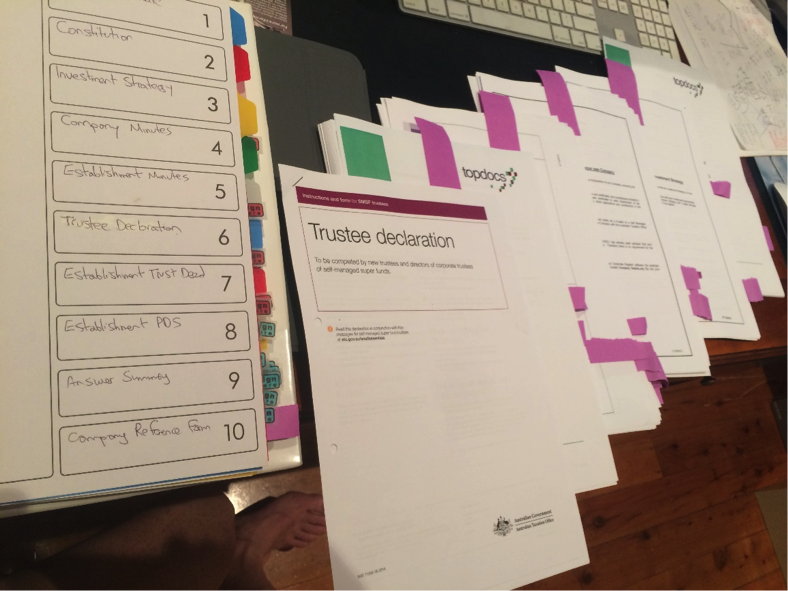

If you’ve decided an SMSF is right for you, you then have to go through the process. While brightday makes it easy to open a SMSF, you should still be prepared to spend a couple of hours completing, sorting and signing the forms. It’s not a bad self-selection process. If you cannot be bothered doing a bit of admin (and a lot of people can’t) then you may not be bothered to spend the time taking an active interest in running your investments and should probably consider not having an SMSF. Having a SMSF is not about Bloomberg screens and day trading.

You can see in the photo the forms that I had to sign – there are two sets of around 200 pages of documents there (comprising trust deeds, establishment minutes, the investment strategy etc) . Each of the two sets requires around 20 signatures. One set is in a nice A4 folder that you keep. A second loose leaf set is returned to brightday.

Managing

Now that the paperwork has been completed, I’ve done all I need to open our SMSF. We can now take advantage of the great tools and functions offered by brightday to run our SMSF. This is the part I am looking forward to, and where I think brightday really distinguishes itself.