Why absolute performance counts

You and two friends have a favourite cafe you visit every day, and it has a customer loyalty program. You’re all working towards earning enough points to become ‘silver members’, entitling you to a free lunch once a month. One day the cafe’s computer system crashes, resetting everyone’s tally. While you and your friends are in the same boat, having all lost the same number of points, it doesn’t change the fact you lost them - and are now back to square one. The time and money you spent trying to achieve a silver membership has effectively been wiped out.

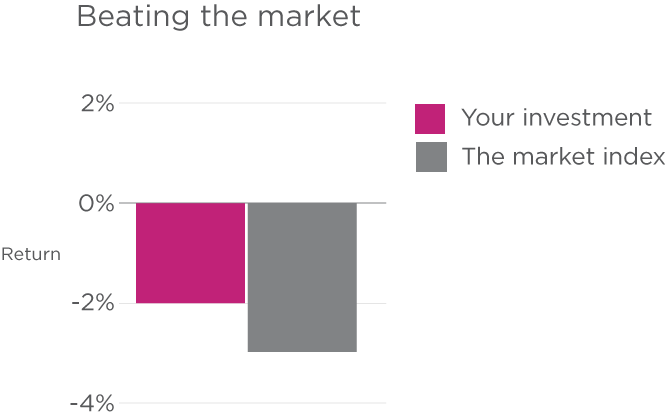

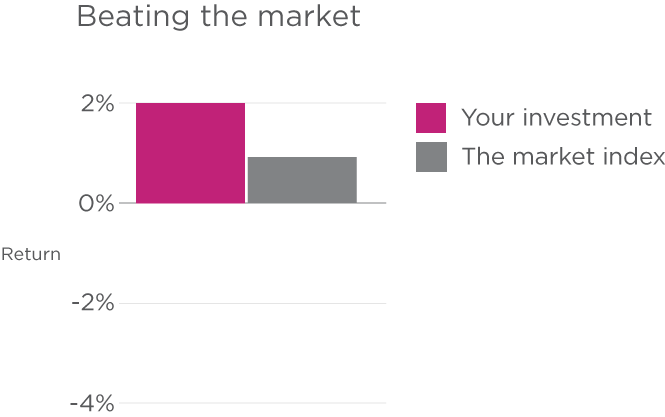

This can happen with your investments, too. When the financial market crashes, it affects your returns and capital. Even if you’re invested with a fund that lost less than the rest of the market, you still lost money. But we’ve been largely conditioned to focus on the difference between us and the broader investing environment, rather than on absolute returns.

What are absolute returns?

Absolute returns are the total percentage of returns (as gains or losses) on an investment over a specific timeframe. It’s a measure that doesn’t take into consideration how these returns compare with the broader market or similar investments (called relative returns).

A focus on absolute returns means that a bad year - where your investment went down, say, 2 per cent - is an objectively poor result, regardless of what’s going on in the investment world generally. A 2 per cent loss, even if the market went down 5 per cent, is not acceptable. Poor returns are poor returns and losses are just that - a loss of your money.

Would you rather beat the benchmark?

Or get a positive return?

Savvy for super

A focus on absolute returns is helpful for those closer to retirement who can’t afford to risk losing capital, or those who simply need positive returns (such as those who are relying on investments for income). As you get closer to having to ‘cash in’ your super, you need to rely on consistent returns and lower risk.

Absolute returns are relevant for those who withdraw an income from their super fund. If your fund beat the index by 2 per cent one year, but still ended up 8 per cent down, you will have less money in your wallet to spend. This demonstrates how important absolute returns are for all investors.

The aim is to achieve a positive return regardless of factors in the broader market that are working against you. For a fund that manages investments on an absolute basis there are few excuses for a bad year, as getting consistent positive returns is the goal. Many low touch investment managers - such as listed investment companies and managed funds - seek an absolute return rather than simply beating the benchmark.

Rather than focusing on growth compared to benchmarks - with the ups and downs this necessarily entails - there is a greater awareness of overall risk minimisation. This includes an emphasis on employing different strategies to achieve this, like holding more cash or using derivatives.

What’s a good absolute return?

An absolute return of 4.5 per cent above inflation per year is acceptable for growth investments like shares or property. When it comes to defensive investments, a term deposit will struggle to give you a positive absolute return after considering inflation because interest rates are so low. But for a fixed income managed fund (or equivalent) there is no reason why you can’t achieve a return that is equal to the cash rate after inflation.