Getting started

You and your partner have decided that a self-managed super fund is the way to go for your financial future together. Depending on your available time (and level of interest), this could well be a fantastic decision that gives you more control of your wealth and the tools to make it grow.

Before you jump in, there are a couple of things to consider. Running through these points as a guide to whether an SMSF will work for you both should help ensure smooth sailing - and hopefully ensure the couple that saves together stays together!

Ask before you start

It’s a normally wise and fairly straightforward decision to combine your super balance with your partner’s. It involves making decisions together on how to invest the total sum if you already have joint finances like savings, a mortgage or other investments. And while it is that simple in essence, there are some finer details that can affect SMSF decision-making that aren’t always immediately obvious.

Hopefully you will have had a conversation about the kinds of investments you’d like to make - be it in property, shares, managed funds, bonds or term deposits. If you haven’t had this basic discussion, it needs to be at the top of your list.

Everyone has a risk comfort level

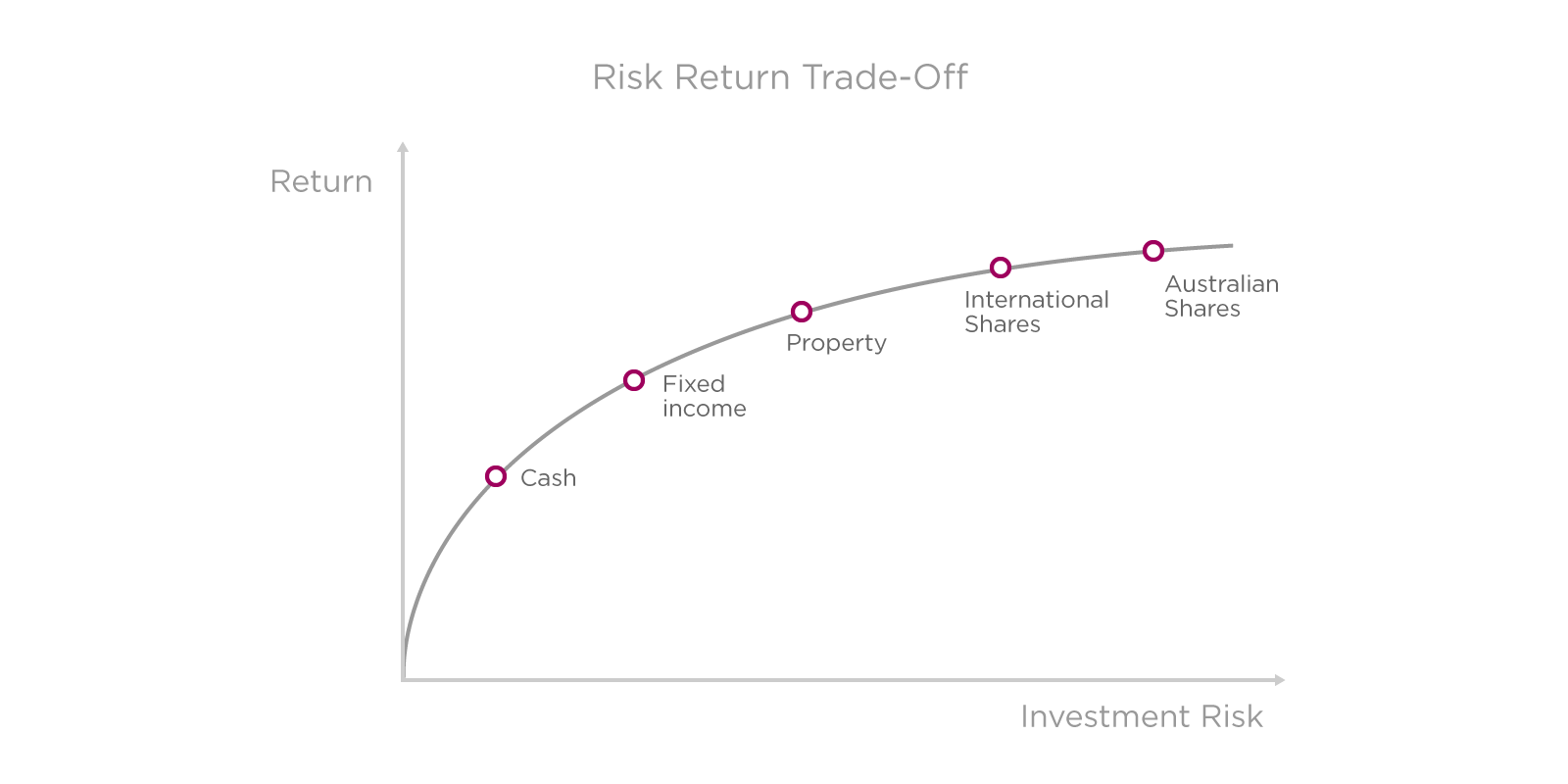

Our personality, and perhaps past experience with money, affects how willing we are to take risks with our savings. Some people are naturally risk-averse, preferring ‘a sure thing’ over something with an elevated risk but the chance of a good return. A basic rule of personal finance is that the lower the risk, the lower the potential returns, and vice versa.

So while you might enjoy the thought of getting a high return that ‘beats the market’ by putting your trust in a relatively high-fee, high-perfomance managed fund, your partner might be more likely to keep all of their cash under their mattress if it were an option! Approaching retirement with the majority of your wealth in growth investments, for example, could suit one of you but be a terrifying prospect for the other. Communication is as vital in decision making as it is in the rest of your relationship. Together, you need to consider how much is spent in different types of investment, what stage of life you are each in and your appetite for risk.

Want to know more about how an SMSF works with two or more people? Register for a phone call from a brightday member services team member - no cost, no obligation.

What will you put your money into?

A good way to approach this is to decide on the breakdown of growth versus defensive investments - and the specific types of investments that make up these brackets, too. How much of your portfolio are you both happy to have in shares, for example? While this is often guided by your stage of life, you might opt for a different approach to work out how much goes where.

Tell your spouse if you have investment ‘must haves’ or definite ‘off limits’ - for example, are you comfortable investing in offshore companies? Does your partner have an unspoken assumption that a portion of the funds will be put into a term deposit?

It’s a good idea to not leave things assumed, but talk everything out before initial misconceptions turn into mountains that undermine not only your superannuation but your relationship.

Who will make investment decisions?

Simply delegating this responsibility to the partner with more expertise or experience can lead to future problems. Perhaps the partner with less knowledge still wants to be equally involved in making the decisions and will need help bringing their understanding up to the same level.

Or perhaps the partner with more knowledge does not want the burden of having full responsibility for investment outcomes - which could cause strain if results aren’t necessarily as predicted. They may also have envisaged having assistance in the partnership for decision-making, and feel overwhelmed with the task if left just to them.

Regardless of how you share the decision making, you’re in it together and you will share the same fortunes. If harmony at home is as important to our happiness as we are led to believe, then considering these points early on could prevent a lot unnecessary grief in the future.

You can request a phone call from one of the brightday member services team - at no cost and no obligation - to discussyour super needs. Or call us on 1800 857 680.