What is a franking credit?

Franking credits are the Australian government's way of preventing the same company earnings from being taxed twice: at the company level as profits and again as dividends in your personal name at your marginal tax rate. Officially a franking credit is how much tax the company has already paid for your dividend, on your behalf.

Franking credits are attached to dividends you might receive from your investment in shares. Not all dividends from Australian companies will offer franking credits, as it comes down to what country a company generates its revenue in. When a company in Australia earns a profit, it pays dividends to its shareholders, but is also taxed 30% on those profits. Investors receive their after-tax dividend, which to help them avoid being taxed a second time might have franking credits attached. Also known as franked dividends, these credits will usually reflect the 30 per cent tax already paid by the company.

To qualify for franking credits, you must hold shares for 47 days. This means you must buy the shares 45 days before the share goes 'ex-dividend'. This minimum holding period demonstrates that you have been interested in holding the shares before the dividend was paid. It shows that you as an investor aren't just buying shares for the dividend and associated franking credit and then selling the shares.

How can franking credits benefit you?

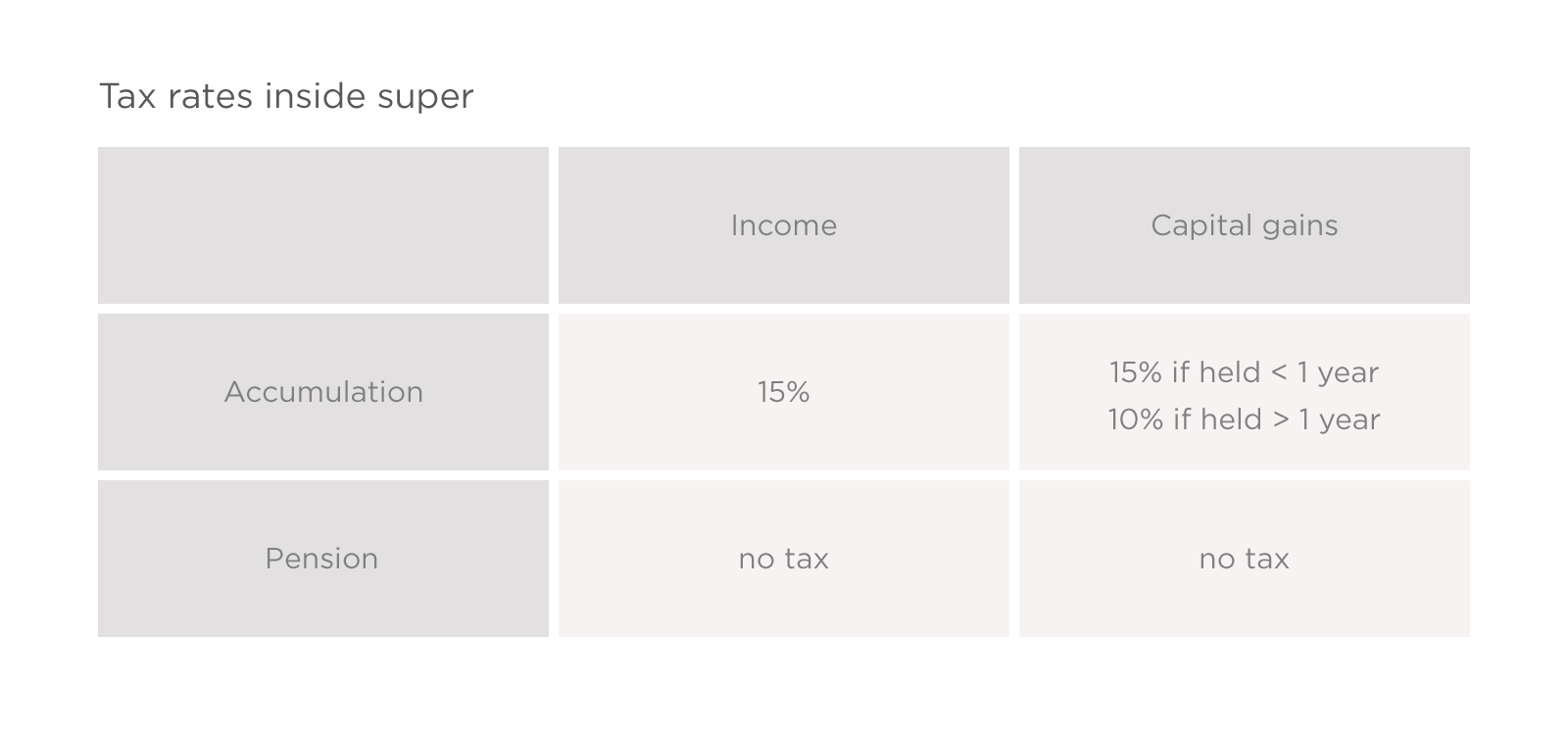

Let's quickly refresh the tax rates inside super:

If you are in the accumulation phase, you are contributing to super. To qualify for the tax rates available to pension accounts you must be withdrawing the annual minimum from this account.

If you are in the accumulation phase, you are contributing to super. To qualify for the tax rates available to pension accounts you must be withdrawing the annual minimum from this account.

The low tax rate inside super means franking credits can benefit you in the form of a cash injection every year post 30 June (once your tax return is processed).

If you receive franking credits and are on a tax rate less than the 30 per cent the company is charged on its profits, you will get a refund of the difference. More money for you! If your tax rate is higher than 30 per cent, you only incur tax on the portion between 30 per cent and the tax rate you are on. What does this mean? You pay less tax!

|

Investor |

Marginal tax rate |

Company A shares |

At tax time |

|

Alan |

15% |

Alan has paid 15% too much tax on his dividends from Company A. His marginal tax rate and the tax paid on his dividends needs to be the same. |

Alan will get back the 15% extra tax he paid on his dividends. This is considered a ‘franking credit refund’. |

The difference between Company A’s tax rate and the tax rate inside Alan’s SMSF means Alan will receive a franking credit refund to around 15% of the value of the dividends. If Alan has to pay any tax on capital gains, this franking credit refund could be used to reduce his tax liability.

Companies offering franking credits

Australian companies that earn the lion share of the profits domestically will offer fully franked dividends. For those companies that earn income domestically and offshore, it is likely they will only offer partially franked dividends, reducing the franking credits you are entitled to.

Fully franked dividends are a favourite of many SMSF investors, especially those in the pension phase. This explains why many self-funded retirees favour the Big 4 banks and Telstra. Each of these companies offer a relatively high dividend yield, which is how much a company pays out in dividends each year relative to its share price (more on this below), and offer fully franked dividends.

If you have a specific company in mind, you can easily find out their past dividend payment history including any franking credits using the ASX's Search dividends page.

Grossed up dividend yield

You might have heard ‘grossed up yield’ before. This is the dividend yield, after the value of franking credits have been considered. Basically it works out the dividend paid before tax was taken out and franking credits offered. Think of it as like the gross salary figure on your payslip before the income tax is taken out, except you have to work this figure out (i.e. ‘gross it up’). Investors often find this information important, especially when it comes to calculating their tax.

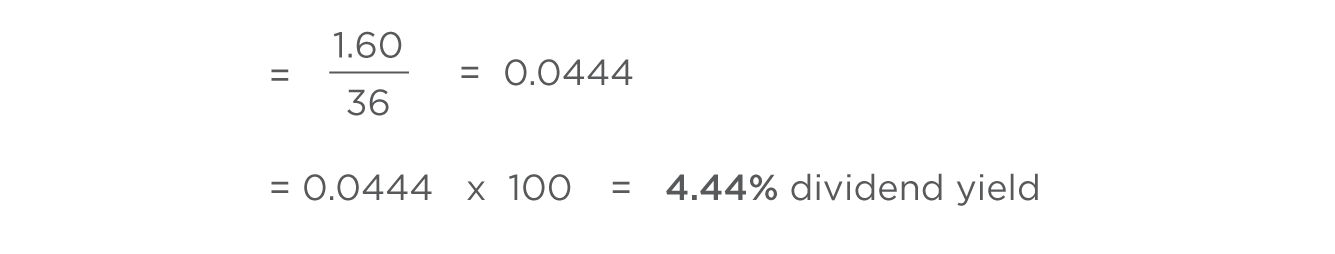

To use an example, say a company pays annual dividends of $1.60 per share, and their stock is trading at $36.00. To work out the dividend yield you divide the dividend per share by the share price and multiply that by 100 to get the percentage, so:

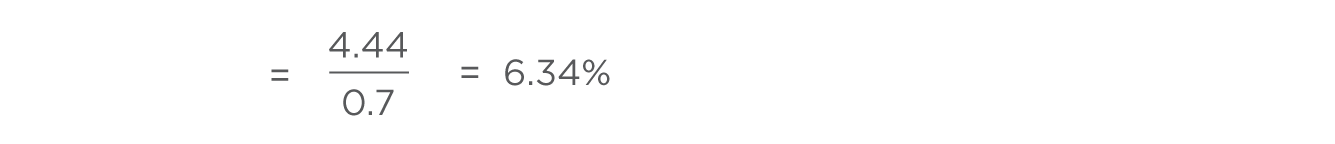

We can then work out the grossed up dividend yield. If the dividend has been fully franked and taxed at the company rate of 30%, calculating is as easy as dividing the dividend yield by 0.7. (This 0.7 comes from 1 minus the 0.30 per cent tax already paid).

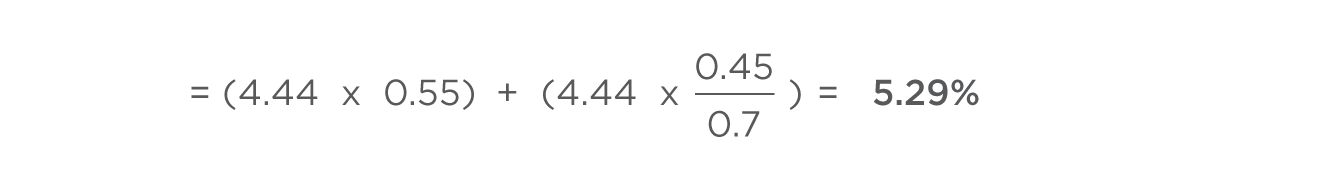

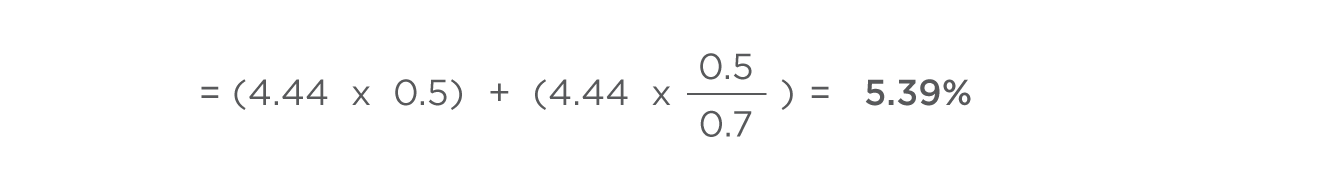

If the dividend is only 50% franked, that is tax is paid on only 50% of the share, you need to show that in your calculations. An easy way is to calculate the unfranked and franked portions separately then add them together.

If the dividend is franked an irregular amount, say 45%, this also needs to be reflected in your formula. Same formulae as above, but remember to divide the franked portion by 0.7.