Getting access to a lifetime's savings

If you're like me, you've possibly been considering just what you're going to do for an income once you've finished working and can kick back in your retirement years. After all, you'll still have bills to pay and mouths to feed: if not others then your own at the very least. Just as well then, that the super contributions your employer has been making (and that you may have been contributing to as well) will finally become available to you when you do retire! Most people access their super by taking a pension. This is sometimes called a super income stream. There is also the option to withdraw funds from super as a lump sum.

Before we can get our hands on our super though, we need to pass two tests. We need to have reached preservation age, which is the age we become entitled to access our super. We must also meet one of the 'conditions of release', which is an action or event that needs to occur before our super becomes available to us.

There are three ways you can meet the condition of release requirement:

- Reaching your preservation age and retiring;

- Reaching your preservation age and starting a transition to retirement pension;

- Reaching age 65.

In addition to the super income stream, a pension can mean government-funded payments like the Age Pension.

When can I start a pension?

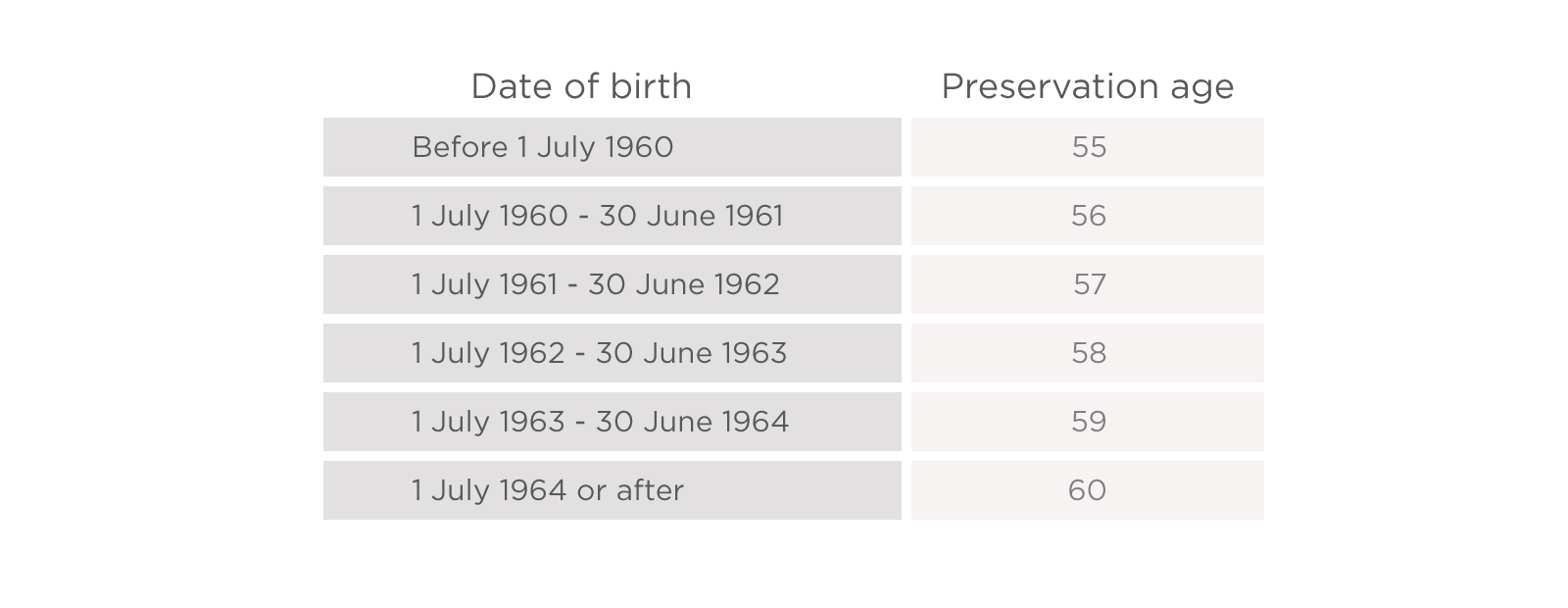

Once you reach your preservation age, you can start a pension. At the moment, preservation ages vary depending on the year you were born. The table below details the different preservation age requirements you will need to meet if you want to start a pension.

If you satisfy the age requirements your super fund should be able to start paying you a cash-based pension - whether you are retired or not.

Under 60 - what you need to know

While we all know that income or withdrawals from super after the age of 60 does not normally attract tax. But this is not always the story if you start drawing a pension or withdraw a lump sum, when you are younger.

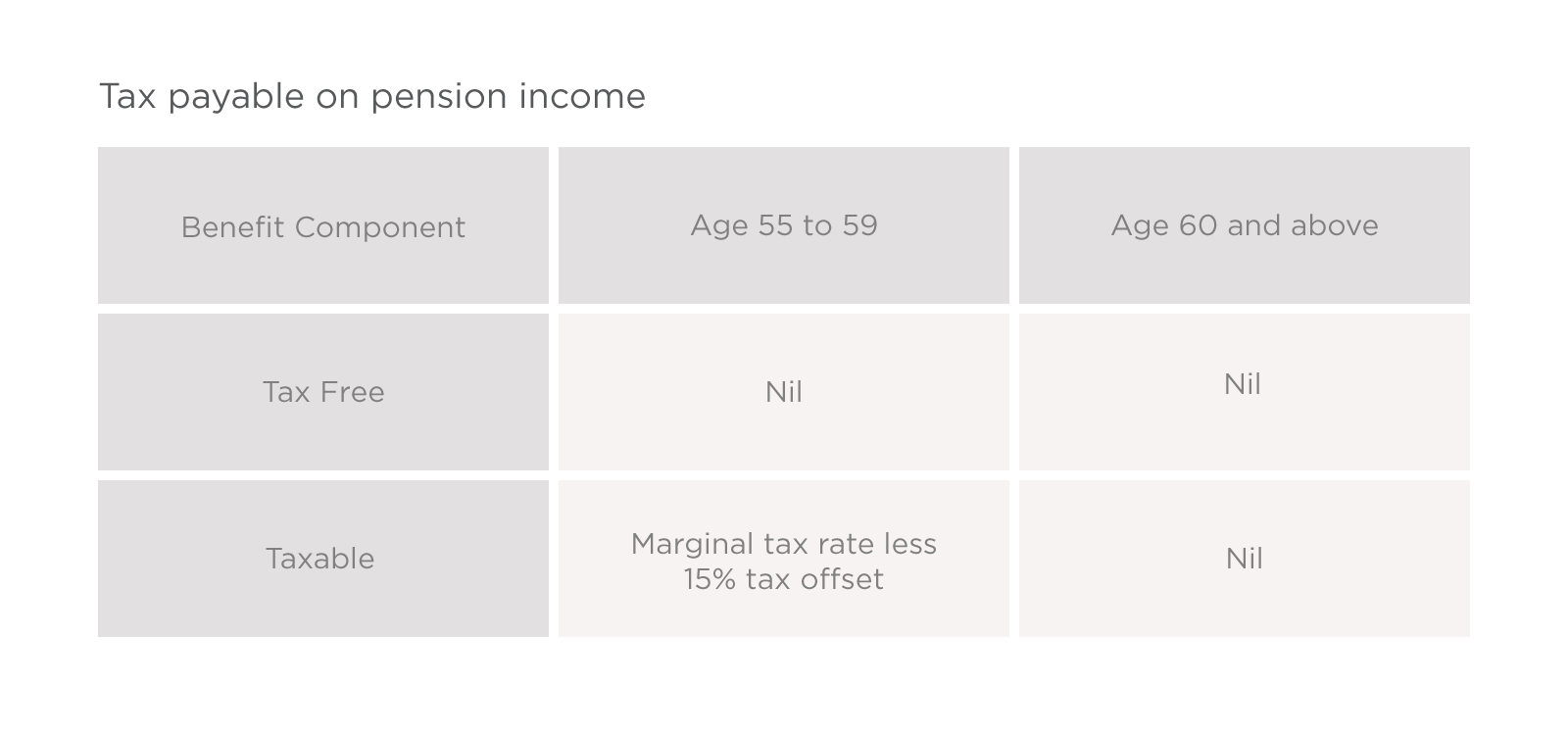

Just to recap - within our super we have tax-free and taxable components. The tax-free component is made up of after-tax or non-concessional contributions and government co-contributions. The taxable component is made up of employer contributions (concessional contributions) and salary-sacrificed contributions.

If you are under 60 and taking a pension, you need to include some of this income in your annual tax return. If you are fully retired, you might only be including your super withdrawal. But if you are still working, it will include your ordinary salary and a portion of the income withdrawn from super.

As the name suggests, you don't pay tax on the tax-free component of your super. But you do pay tax on the taxable component.

Any income from your taxable component is taxed at your marginal tax rate, less a 15 per cent tax offset.

When it comes to working out how much you need to pay, your super provider should give you a summary of what was withdrawn from super during the year. This should clearly specify the taxable and tax-free components.

The quick way to work out is to think about if you have made any extra contributions to super using your savings. If you haven't, you probably have mostly taxable components. You can also get this information from your super provider at any stage.

What kind of pension can I have?

If you've met your preservation age you have the option of being able to start either:

- Account based pension if you are fully retired;

- Transition to retirement (TTR) pension if you are still working and want to withdraw an income stream from your super.

Under a TTR pension you don't actually have to be fully retired to access your super. You can still work, contribute to super and take a pension all at the same time.

What is the definition of retirement?

To start an account-based pension, meeting the preservation age is only one half of the requirement! You must also be retired. To be considered retired you must not be planning to work again, either in a full-time or part-time capacity. In most cases you will be asked to sign documentation confirming that you don't intend to work again.

Signing off on your intention to not work again is relevant only to that point in time. You can still return to work if your circumstances change or if you actually want to go back to work, either full-time or part-time (more than 10 hours per week).

Without trying to confuse you, once you have retired you could take a part-time job, clocking less than 10 hours per week and still be considered retired. You can't stay with the same employer, reduce your hours and classify yourself as retired as you haven't met the requirement of not having the intention to work again and signed the relevant paperwork.

You're 65

Simply reaching age 65 is a condition of release. So even if you are age 65, you're still working and retirement is not on the agenda, you are able to access your super and start taking a pension!

Why would I start a pension?

There might be a variety of reasons why you would choose to take a pension when you do, but in most cases it is likely to fund your living expenses. It also can change the tax rate of capital gains and income inside the super environment, provided you have set up a pension account.

Once you start taking a pension from your fund, the tax rate of your super goes to zero for income and capital gains. To be clear, this only relates to those benefits in your pension account. So if you are still contributing, the favourable tax treatment won't apply to your accumulation account.

If you have an SMSF this means you can realise capital gains on the portion of your investments in the pension account and pay no tax! Transitioning to a pension account isn't a reason to sell down investments with capital gains alone, but it might be something you think about doing at some stage.