Understanding the trustee choice

Members of a self-managed super fund (SMSF) have the authority to make all of the decisions about how and where their savings are invested. With this power comes more responsibility, as you also assume the role of trustee, which is the person responsible for all of the investment decisions. There are laws that cover these roles, and all trustees must understand and follow these laws.

Similarly, industry and retail super funds also have professional trustees in place to oversee the operations on behalf of their fund members.

But unlike retail and industry funds, at least one SMSF trustee must also be a member of the SMSF. This means all decisions are left in the hands of the same people who will receive the money when they reach retirement.

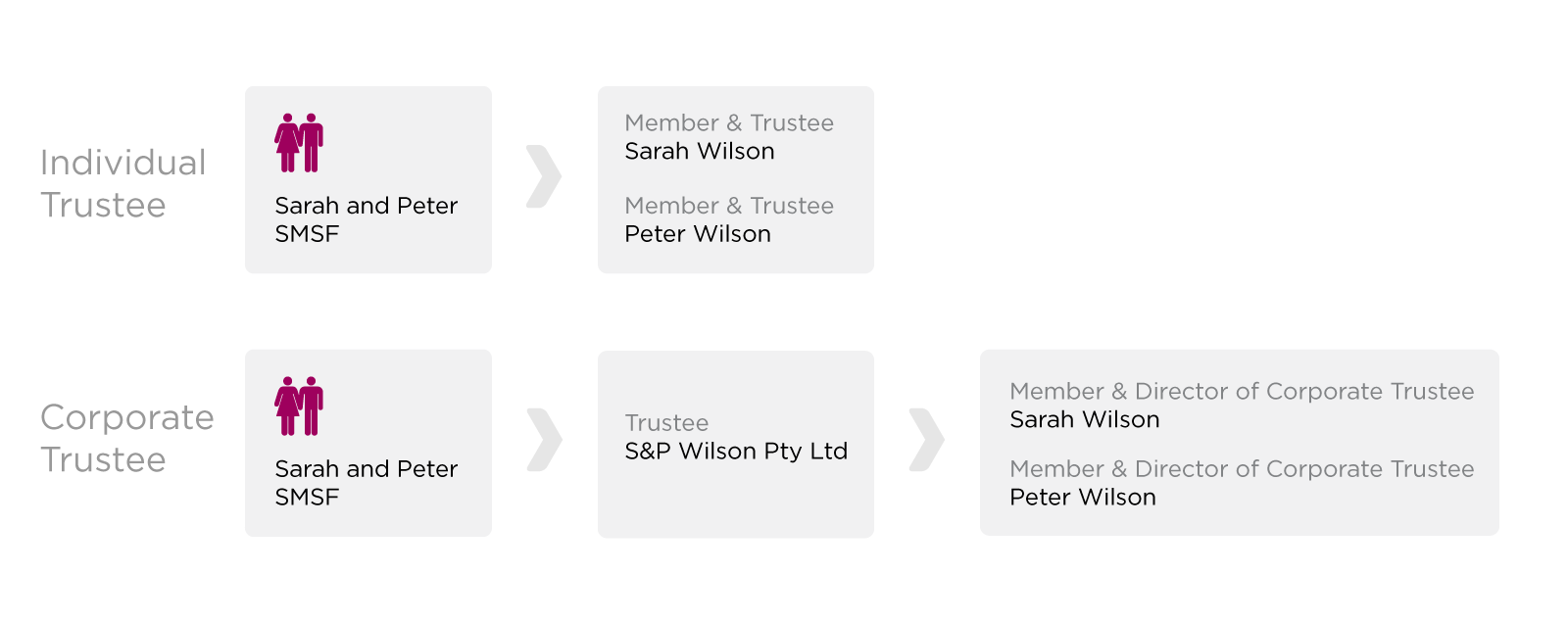

If you're setting up an SMSF, the first question you need to ask yourself - before you get to the application form - is whether or not you want to have individual trustees or set up a company, often referred to as a corporate trustee. This is an important decision, so let's recap a couple of key terms:

- A trustee is responsible for making investment decisions and ensures the SMSF is following the rules;

- A member has a balance invested in the super fund and is either contributing or withdrawing a pension.

Appointing trustees

If you're going to be the only member of your SMSF you have two options when it comes to the appointment of trustees.

- You can set up a company to act as the trustee for your fund. You would be the director of this company.

- If you don't want to set up a company, you will need to have two trustees. You will need to find a second person to be a trustee alongside you. This person doesn't need to be a member of your fund, meaning they don't need to have a monetary stake.

Two or more

When there are two or more members, the same options around individual or corporate trustees apply. Let's take a look at how each option will be viewed on your SMSF.

Whether you choose to have an individual or corporate trustee to oversee your fund, neither option will directly affect the performance of your SMSF. This particular decision is more about personal preference and in some cases estate planning. And if you wish to invest your funds in property, you can only do so with a corporate trustee structure in place.

Individual vs corporate trustees

As explained above, which one you choose (when the choice is available to you) comes down mostly to personal preference. But it can't hurt to understand the benefits that each option can provide you.

Setting up an SMSF with an individual trustee is often less costly to establish than one with a corporate trustee, simply because you don't face the costs of establishing a company name do not factor into your expenses. Individual trustee funds are also subjected to less reporting requirements than corporate trustee SMSFs, which also must report to ASIC due to having a company act as a corporate trustee.

The benefits of appointing a company as a trustee normally outweigh the extra costs. Operating a fund with a corporate trustee makes it easier to add and remove members from the fund. The name of the fund and corporate trustee can stay the same; the only changes are the names of the directors, who are also members of the SMSF. If a member dies, the directors of the company need to be notified and the trust deed of the SMSF updated to reflect this. Compared with individual trustees, this is a very straight forward process. Having a corporate trustee gives an SMSF an indefinite life.

When individuals are the trustees of an SMSF, if one trustee is to pass away another member either needs to take their place or a corporate trustee needs to be arranged. While the actual name of the SMSF can remain the same, all investments will need to be transferred to the new trustee structure. There is a substantial amount of paperwork involved to do this. While a corporate trustee does cost more, it means you can avoid the pain of having to make significant decisions if your partner passes away.

Another advantage of a corporate trustee is the limited liability it provides. Basically this means your liability is limited to the assets held within your SMSF. For example, if your SMSF cannot repay the loan on its investment property or there is a public liability claim, only assets within your super fund could be contested, not you personally. It is for this very reason you are required to have a corporate trustee if you are borrowing to secure a property within your SMSF through brightday.

Costs

These are the basic costs of running your SMSF through brightday and do not include the charge for per cent of funds under administration.

| Corporate Trustee | Cost | Individual Trustee | Cost |

| SMSF establishment fee | $132 | SMSF establishment fee | $132 |

| Establishing corporate trustee | $659 | SMSF tax return, financials, audit | $990 |

| Annual ATO levy | $259 | Annual ATO levy | $259 |

| ASIC agent surcharge | $250 | ||

| SMSF tax return, financials, audit | $990 |