Safeguarding your family's future

If the need for insurance was plastered all over town like graphic anti-smoking advertisements, 95 per cent of Australians would probably be better insured than they are today. Unless you can rattle off the details of your insurance policy, you could be one of many who are under-insured. Under-insurance occurs when your policy cannot cover all of the losses you might suffer, leaving you worse off financially.

Insurance is a way to transfer risk to a company, the insurer. Life insurance relates to life, health, or something like getting so sick or so seriously injured that you can no longer work. We never expect it, but it can and does happen. As an example, cardiovascular disease alone prevents 1.4 million people living a full life, reducing the earning capability of nearly 10 per cent of adult Australians (not to mention adding to their medical bills). The right insurance cover can reduce the financial burden of illnesses or injuries.

Think about insurance ... now!

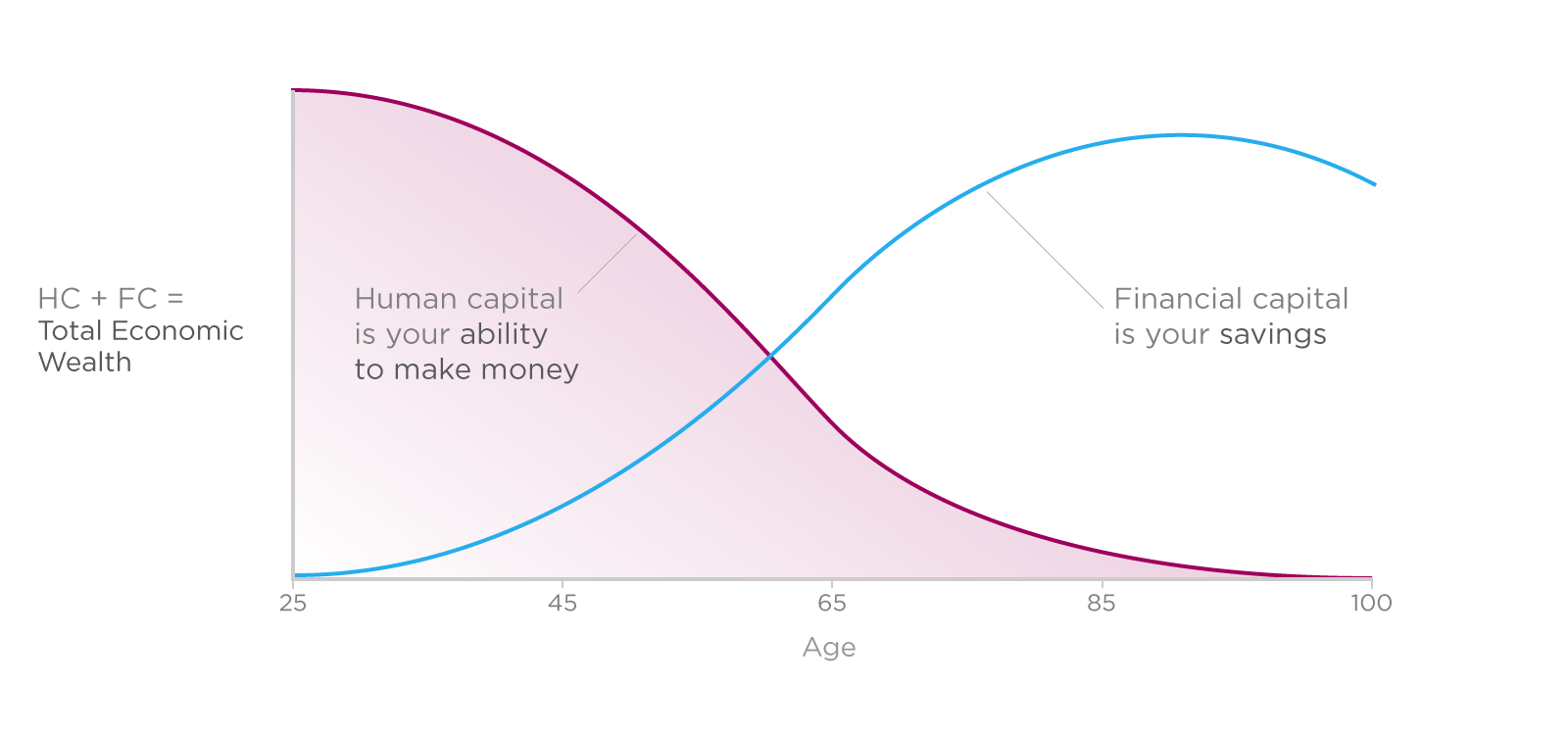

There is a common misconception that we only need insurance when we are old. This could not be further from the truth! The younger we are, then perhaps the greater the need. From an insurance perspective, we could be worth the most at around the age of 25 - this is our 'human capital', based on all the income we expect to earn for the rest of our life. It means we need to protect ourselves against possible events that could damage our earning potential. Insurance allows us to close the gap between our earning potential and the cost of living should a medical emergency strike.

It's not just about you

While insurance centres on you as an individual, we know that it's about far more. It is about making sure your family, your partner or children don't have to shoulder an extra financial burden should something happen to you and the income you earn. You're working hard to pay off your mortgage, build your savings and, if you can afford it, maybe even contribute a little extra to your super. But the reality is that even the best plan to secure your financial future is no good without adequate insurance.

It's ridiculous that we'll willingly insure our house, our car and in some cases even our pets, but we don't adequately insure our greatest asset, ourselves.

What type of insurance?

Many industry and retail funds offer a default level of insurance, but it could be for a standard amount. It's likely that if you only have this amount of insurance, it won't be as much as you might need. What amount you'll need is determined by a number of things like: your current level of debt, any dependents you might have and whether you own your home, among other factors. Let's take a look at each insurance category to understand the protection on offer and to get an idea of the level of cover you might consider.

1. Life insurance: this insurance is to provide for your dependents upon your death by paying out a lump sum. Generally speaking, you'd want that amount to cover any debt as well as provide an income stream for your partner for a certain number of years, especially if there are children or other financial dependents involved. Because everyone's life circumstances are constantly changing, that amount will also change so it's important to regularly reassess the amount you're insured for. To learn more, read The importance of life insurance.

2. Income protection insurance: in the event of an accident or even an extended period of illness, this insurance can provide you with up to 75 per cent of your salary for a specified period. Depending on the policy, income protection can run for either a period of two years, five years, or until you are 65. This product is designed is to ensure you have enough funds to pay the monthly bills and put food on the table until you are able to return to work.

3. Total and permanent disablement (TPD): TPD insurance comes into play if it has been medically determined you are no longer fit to work. The money received should be enough to pay off any debts or fund a place for you to live, cover medical costs and provide an income stream.

4. Trauma insurance: Perhaps the most overlooked of all the insurances, trauma insurance is designed to provide you with a lump sum in the event of a major trauma, generally health-related - heart attacks, cancer, plus a host of other illnesses. Trauma insurance should cover your medical costs, which, along with lost income, can be in the hundreds of thousands of dollars.

Paying for insurance

Over the years there has been a bit of commentary about insurance premiums draining your super balance. The best way to manage this may be to salary sacrifice a portion of your pay into your super to offset the cost of your insurance premiums. This way your super balance is not reduced and you get to take advantage of the other benefits of salary sacrificing.

For example, if your insurance premiums cost $150 per month, it means you need to contribute around $180 extra to your super every month to fund this (a little bit more because of the 15 per cent tax on super guarantee contributions paid by your super fund). What does this cost you after tax? Well it depends on your tax bracket. If you are earning less than $80,000 the cost to you after tax is about $120, which is less than the actual premium you pay.