Account-based pensions

As a young child, I used to watch Mum make a chocolate cake from scratch, maybe every second weekend. When I say 'from scratch' I mean from the packet, with just the other essential ingredients to keep everything together. I would try to dip my finger in the cake bowl, especially when it came to making the icing, and mum would always tell me off because it wasn't ready. Your superannuation is like that freshly-baked cake. The contributions are like the ingredients, while the laws stopping you from getting your hands on the money early is like your mother slapping your hand for trying to put your fingers in the cake bowl.

But when the time comes, and you're of the age where you can access your super, you appreciate those rules being in place over the 40-plus years you've been working and building wealth for your retirement. The cake tastes just that little bit nicer.

Most Australians choose to receive their super, once it becomes available to them, as an account-based pension. This provides a regular series of payments from your super, paid into your nominated bank account. To get access to the income stream offered by an account-based pension, you must have reached your preservation age and met a condition of release.

The lingo

Before we go any further, we need to understand two commonly-used terms:

- Preservation age: the age we have the right to access our super;

- Condition of release: an action or event that needs to occur before you can access your super.

Once you start an account-based pension you must withdraw the minimum amount from your fund each year, regardless if you need this income or not. Unlike an annuity, you are not guaranteed a certain amount of income each year. So once the funds in your pension account run out, that's it.

A common question is 'just how much can I take from super?' Well there is no cap on how much you can withdraw! It's not unusual for many Australians to withdraw a lump sum from their super to clear any debts upon retirement, all the while still leaving enough to live comfortably.

Starting an account-based pension

Whether you have Complete Super or an SMSF, you will be required to complete a form that helps move your super from an accumulation account to a pension account. If you are with brightday's Complete Super you will move to Complete Pension. If you have an SMSF, you won't notice any difference to your account name or details. You will simply have a pension account created - find out more about this here.

There are four key points to know:

- You must have: either reached your preservation age (found here) and be retired; or turned 65;

- A minimum pension payment must be paid each year;

- Most funds should give you the choice of when you would like to receive your pension payments, or lump sum;

- You can commute your pension to a lump sum, which means you withdraw an amount to stop the account-based pension. You might be best to speak with a Financial Adviser before doing this.

Need to withdraw minimum each year

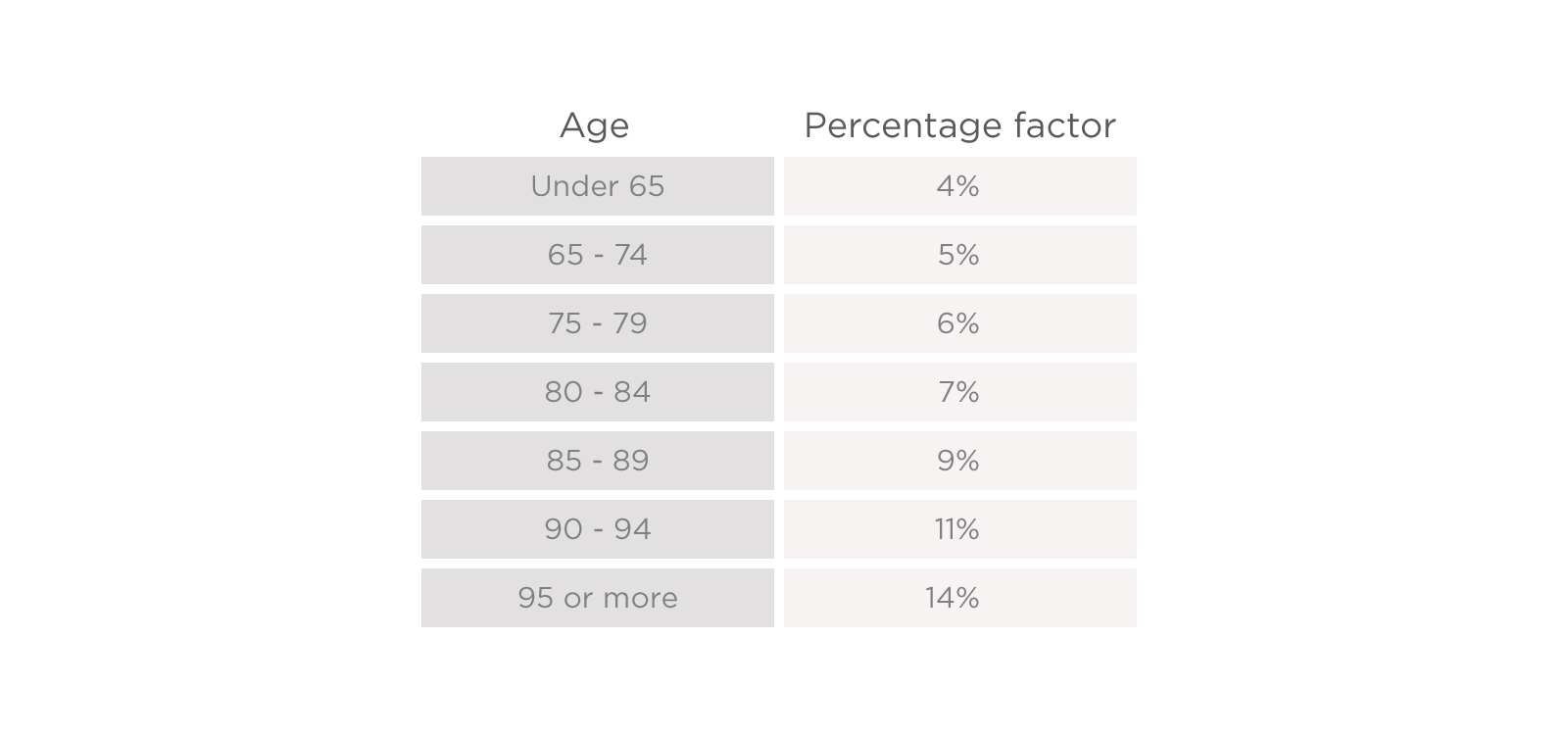

Once you start an account-based pension it means you will need to withdraw a minimum each year. The amount to be drawn is dependent on how old you are.

How much do I withdraw?

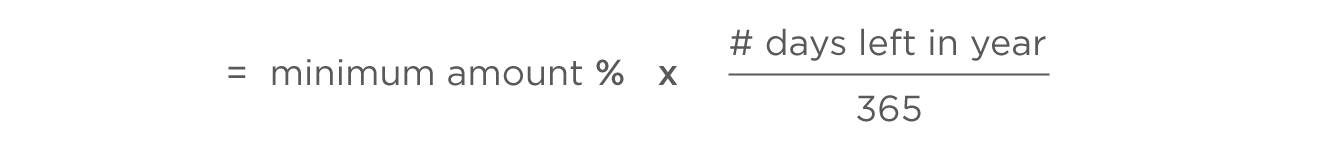

The way you calculate the dollar value of your pension is as follows:

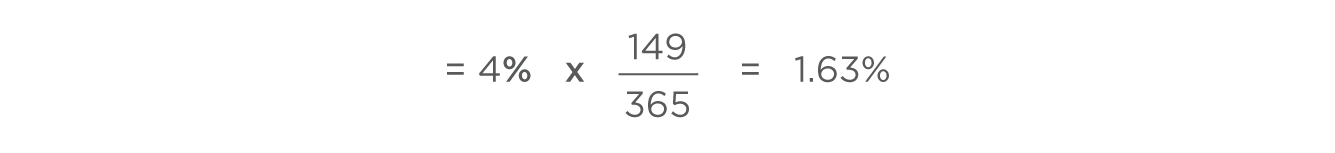

If you create a pension account on 1 February, there are 149 days until 30 June. So your minimum pension amount is worked out as follows:

If you have $300,000 in your pension account on 1 February, it means you need to withdraw a minimum of $4,898 in the current financial year. Every time you transfer more funds into the pension phase, a minimum needs to be worked out for this pension account. Those with an SMSF will have multiple pension accounts - it's normal and completely within the rules.

While the amount you need to withdraw from super increases as you age, the actual dollar value is based on your account value at the start of each financial year. This means your minimum amount will likely change year by year, which is why there is no guarantee over how much you will get annually.

For pension accounts created throughout the year you will only need to take a pro-rata amount, based on the balance of the pension account at the time it is created. There is however some leeway given to pension accounts created in June as it is so close to the end of the financial year. These accounts have no minimum withdrawal amount requirements, and there is no limit on the amount you can withdraw either.

If you don't need the minimum amount you can think about contributing it back into super.

What if I'm under age 60

If you are under age 60, you will need to include any income from the taxable component of your pension in your tax return for that financial year. We talk about this in more detail here.

The tax advantages of this strategy?

Once you start an account-based pension you will be delighted to know any capital gains and earnings within your pension account will not incur any tax. While you are contributing and holding funds within an accumulation account, you will incur 15 per cent tax on income and a minimum of 10 per cent on capital gains.

Make it to age 60 you will receive all payments from your super tax-free.