It's different for everyone

Whether it’s your grandma enjoying scary amusement park rides, or your teenage nephew who squirrels away every dime he makes at his part-time job, it’s clear we all have different risk tolerances, and needs, depending on our personalities and stage of life.

Investing is a matter of weighing your options and picking the highest potential for gain while still mitigating risks - making sure your choices are appropriate for your current situation and needs.

Risk and potential gains

Risks include the permanent loss of capital. It’s when you either have to sell an investment and it’s worth less than what it was when you purchased it, or even falls to zero.

The way to manage this risk is to make sure you have a long enough time frame for the asset class you are invested in. So even if your investment falls in value, you should be able to stay invested for longer, so it can recoup losses before you need to sell it.

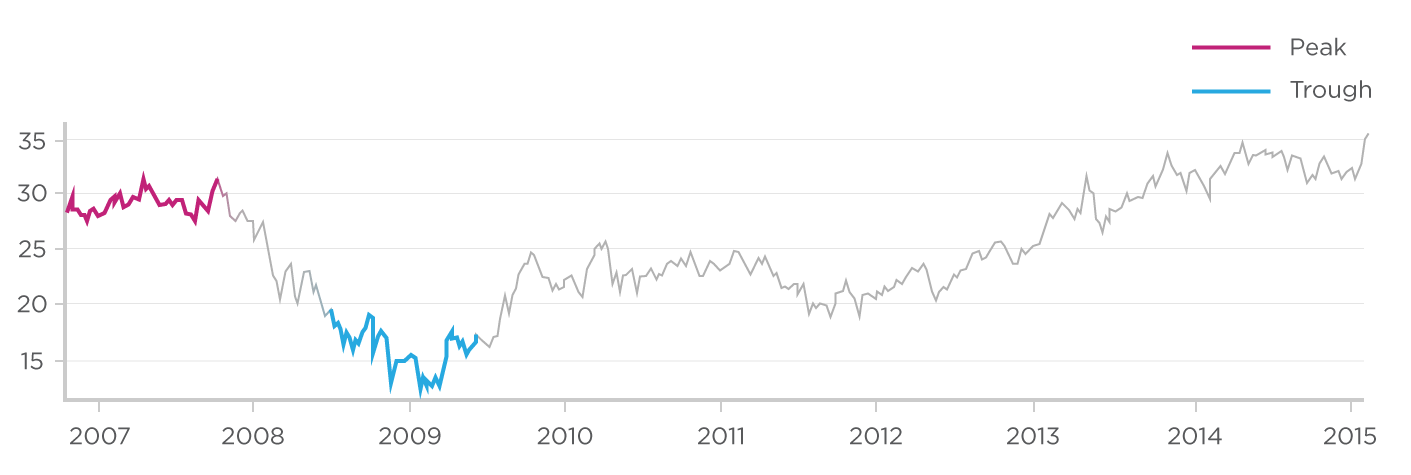

If you bought ANZ shares at the end of 2007, you would have seen your investment halve in value over the following year. If you needed to sell ANZ at the low point of 2009, you would have realised a loss on your investment. In other words, you would have realised the risk of losing some of your capital. But if you didn’t need to sell at that time and could wait for it to rebound, you were in for some tidy gains as the shareprice rebounded and healthy dividends were paid.

It doesn’t matter if you don’t sell when the shareprice hits its peak (it’s not realistic to think you can time the market perfectly), as long as you have achieved the return you were seeking.

The risk of getting the balance wrong

Another, less discussed risk is investing in the wrong type of asset for your stage of life. Whilst investment advice regularly overlooks this risk (more so when young people invest in defensive investments), it is important to recognise. But there are ways to manage this potential problem whatever your needs.

If you’re in mostly growth investments and you’re about to retire, there’s a risk that you will lose money because you’ll be forced to sell when your personal circumstance requires it rather than when its most profitable. The more likely you are to need to access your savings in the immediate to short term, the more you should look towards increasing your defensive investments like cash and fixed income.

If you’re in the earlier or middle stages of your working life, and have plenty of time to wait out the downturns of share investing, growth is best for you.

For example, if you’re 25 and only invested in cash or defensive options, you run the risk of missing out on significant potential gains from investing your savings in growth investments. As shown above, it could cost you 5-6 per cent in returns (or more). For a $200,000 super portfolio, that’s between $10,000 and $12,000 per year.

The level of risk is determined by the potential for loss, as well as forfeited potential for gain - or, ‘opportunity cost’.

If you put your money in defensive investments that provide zero returns rather than in assets likely to give you higher returns, this represents an opportunity cost. But it also lessens the risk of loss on your capital - which is helpful if you are retired or close to it.