Growth and volatility

Emerging market shares can be an exciting addition to your portfolio. But as always, that excitement carries an element of risk.

Just as they have a higher growth potential than mature markets, emerging markets can also be more volatile than the developed market environment of most Western nations. But if you understand and can cope with these risks, buying into emerging markets can offer the chance to benefit from the developing world’s growing middle class.

What is an emerging market?

A country is considered to have an emerging market economy if it fulfils a number of criteria, predominantly if it has fast economic growth, compared to developed nations.

Along with economic development and size, these countries generally have weaker laws and regulations - such as protection for shareholders - and are often not as efficient, as their more developed peers.

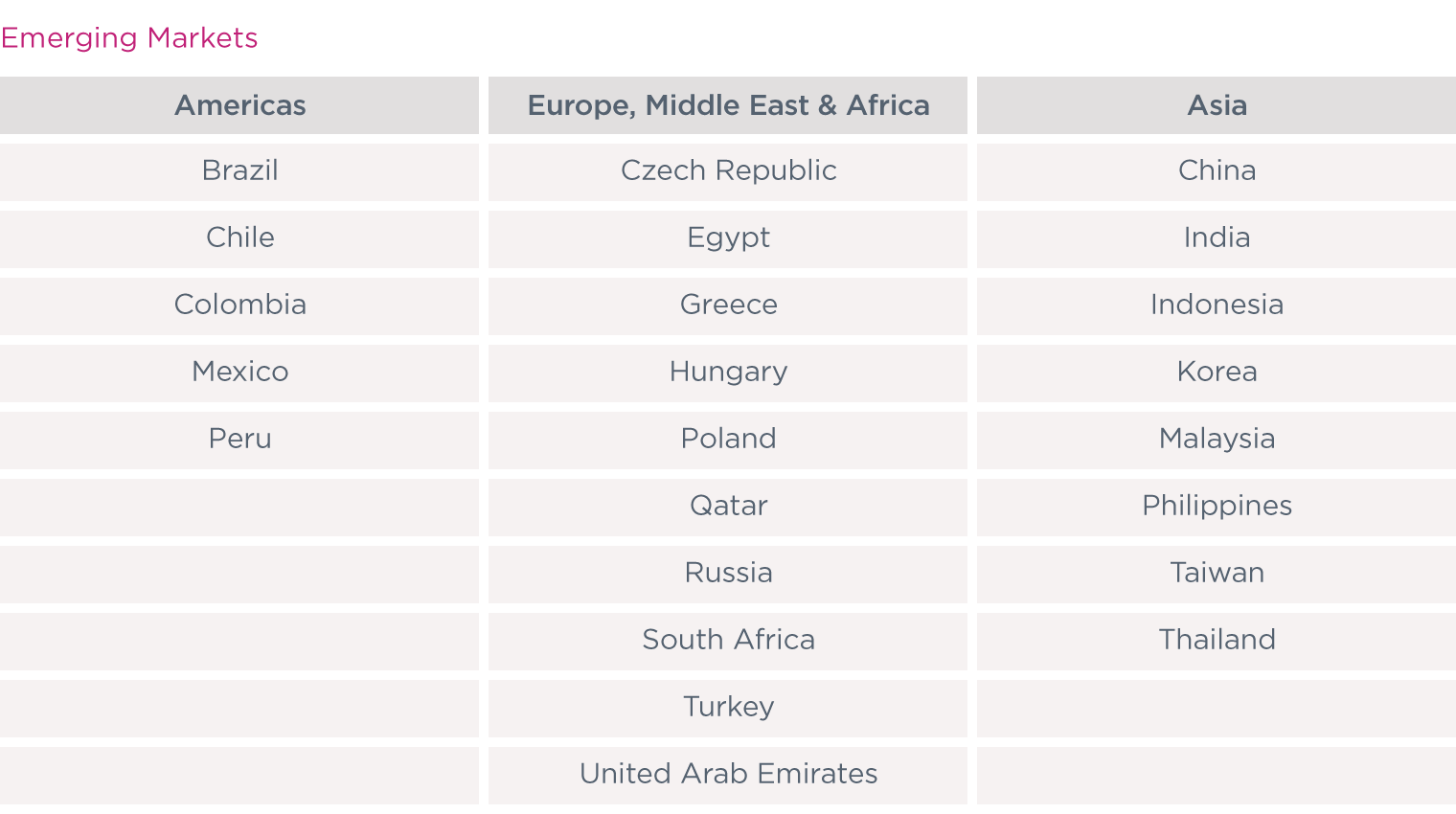

You might be familiar with the term BRIC, coined in by Goldman Sachs executive Jim O’Neill in 2001 for the group of the largest emerging markets in the world: Brazil, Russia, India and China. MSCI, which runs one of the leading emerging markets indices, lists the countries they define as emerging:

Source: MSCI

A few years back, financial commentary was peppered with “BRIC this” and “BRIC that”, and from 2001 these economies have grown from 8 per cent of the world’s economy to 19 per cent (the whole emerging markets group is about half of global GDP). Recently, however, with Chinese growth slowing, Brazil nearing a recession and Russia’s oil price falling, economists are broadening their gaze in the emerging markets sector.

Instead, the emphasis has shifted towards population growth in a larger amount of emerging market nations, where average incomes have risen and poverty levels have fallen. This has resulted in a growing middle class whose consumption of domestic products has increased dramatically.

But while domestic consumption might be supercharging growth in such sectors, it often comes with an increased possibility of political unrest or corruption, high share price volatility and low emphasis of workers’ rights in emerging market countries.

Key characteristics

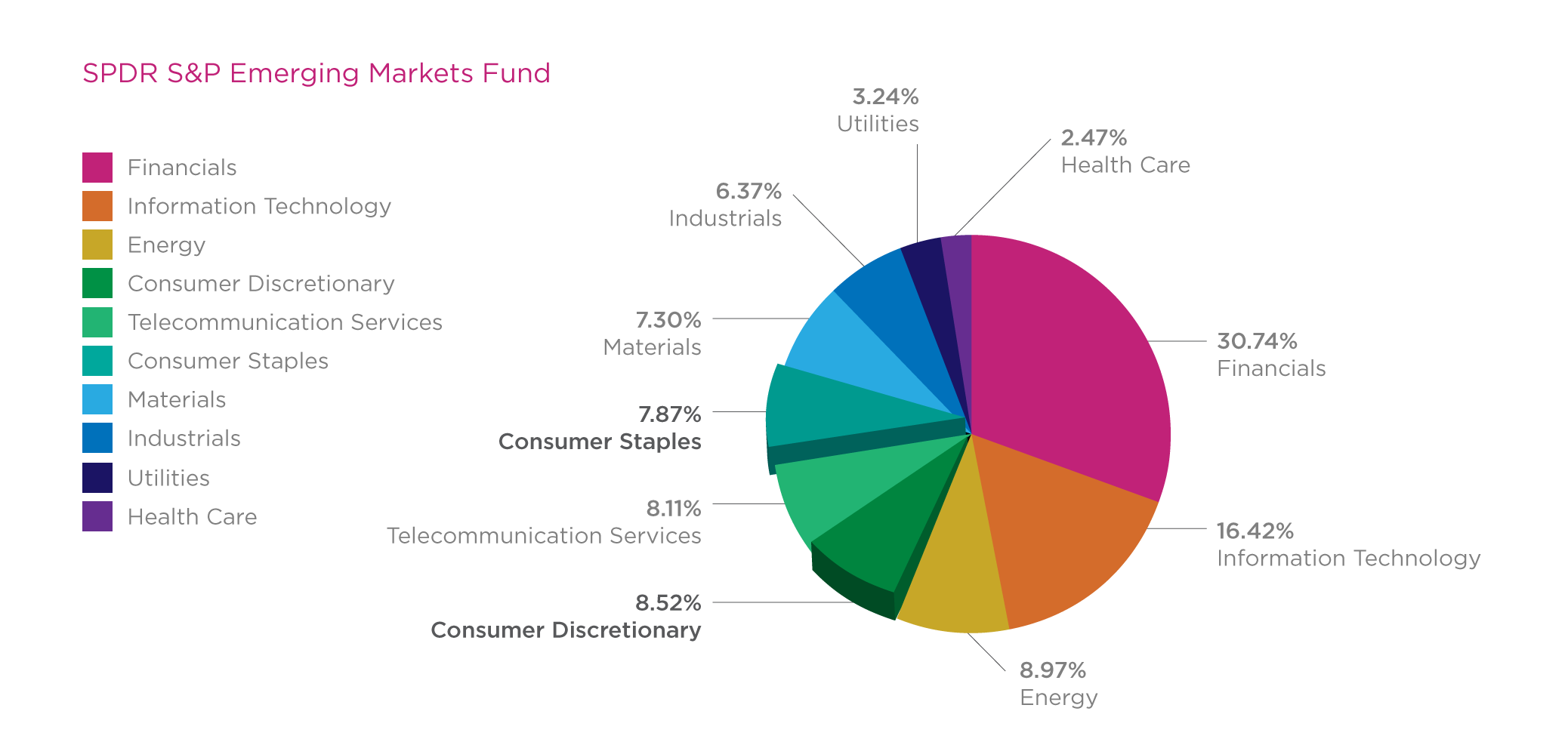

While we have traditionally thought emerging market companies provide developed economies with TVs and fridges, many companies will primarily focus on the domestic market. This has meant a boom in consumer staples and consumer discretionary sectors, as you can see from this breakdown of this emerging market fund:

While shareprices in developed markets are less volatile than their emerging market counterparts, they also have less potential for growth. Investors in them should realise they are giving up a level of predictability for the chance of higher growth.

The countries these companies are located in have more probability of political instability and infrastructure problems, and the standards around running a company and serving shareholders are nowhere near as strict as in developed countries. There isn’t as much information available to investors about the company or the environment they operate in and businesses find it harder to access capital.

Currency in emerging markets can fluctuate regularly, which will have an impact on how your investments perform. There are fund managers who take this into account and try to mitigate the exchange rate effect on your investments, but this again carries a high level of risk and isn’t completely emancipating.

How to buy emerging markets

Emerging market shares give investors a good opportunity to diversify their portfolio. Share price cycles generally move at different speeds to developed nations - rising and falling at different times.

There are many ETFs (a low touch investment that you can hand over the management of to someone else) that track emerging markets indexes or managed funds that specialise on a collection of emerging market companies around the world, sometimes by sector, or by country.

As with many international businesses, there is a likelihood any dividends you are able to receive will not be as high as you are used to (Australia companies generally have a high dividend ratio) so your returns will be dominated by capital gains and losses.

Given the volatile nature of emerging markets shares should be considered a long-term investment (be prepared to invest for at least three to five years). If you take the brightday stance - around investing about 50 per cent of what you have allocated for growth investments into Australian shares - then you need to figure out how much of the rest you want exposed to emerging markets, based on your own risk profile.