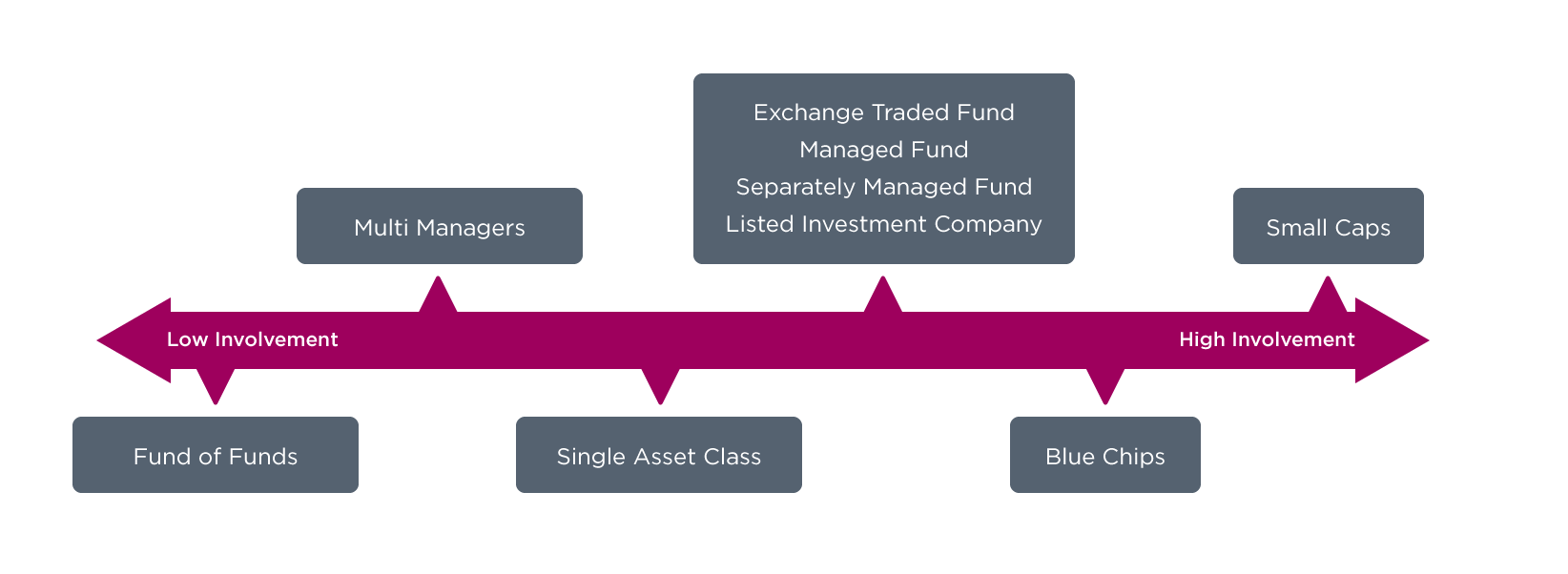

Low touch or high touch?

Investments are either low touch or high touch. This means that you need to spend a little time (low touch) or a lot of time (high touch) managing them.

With low touch investments you give your money to someone else to manage. You choose who to give your money to, and they choose what to invest it in.

The way it works is you select someone you can trust to invest your money in an agreed way. You're not involved in the day-to-day decisions of what to invest in, they do it for you. This style of investing could take as little of your time as one hour every three months.

With high touch investments, you make the decisions about what to invest in, and you invest it yourself. Here, you are the person that you trust to invest your money in a way that you have determined. You are taking responsibility for the day-to-day decisions of what to invest in. This could take as much time as you want, but is a much higher time commitment than low touch investing.

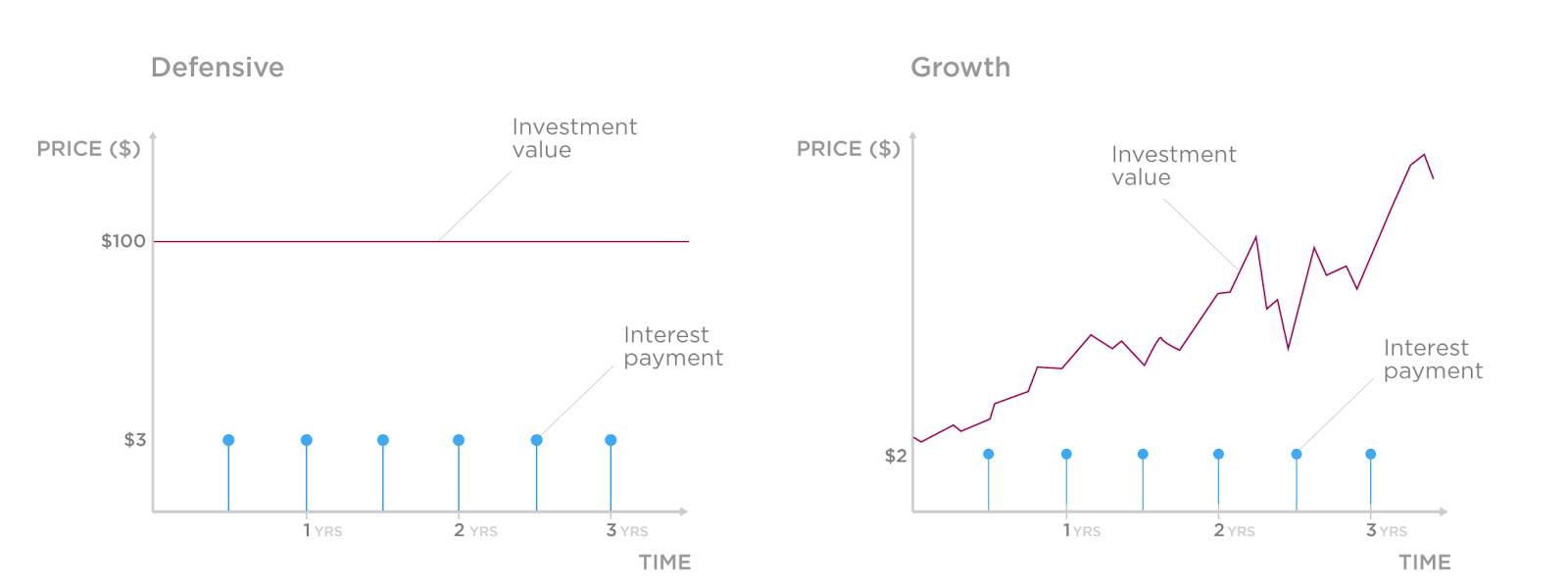

Growth or defensive investments?

Growth investments will typically grow over the long term. Defensive investments will not grow much - if at all - but typically pay regular income over the long term.

Growth investments are normally businesses, like Apple or BHP. We invest our money in them with the belief that they will get bigger over the long term. Usually we are buying a very small part of the business - a 'share' - and so become a part-owner of the business.

Successful businesses produce profits, and growth businesses typically reinvest most of these profits back into the business. The idea is that the value of the business will increase over time because they are doing a good job and are using the profits to expand and improve their business even more. The value of your investment will grow at the same time. But remember some companies do better than others, which means some growth investments will do better than others.

Defensive investments seek to produce stable returns (income) on your money. The idea is that you can rely on a certain income being paid to you in exchange for you investing your money.

Typically, defensive investments are less risky than growth investments but the trade-off is that they typically do not give you as big a return on your investment.

Different types of risk

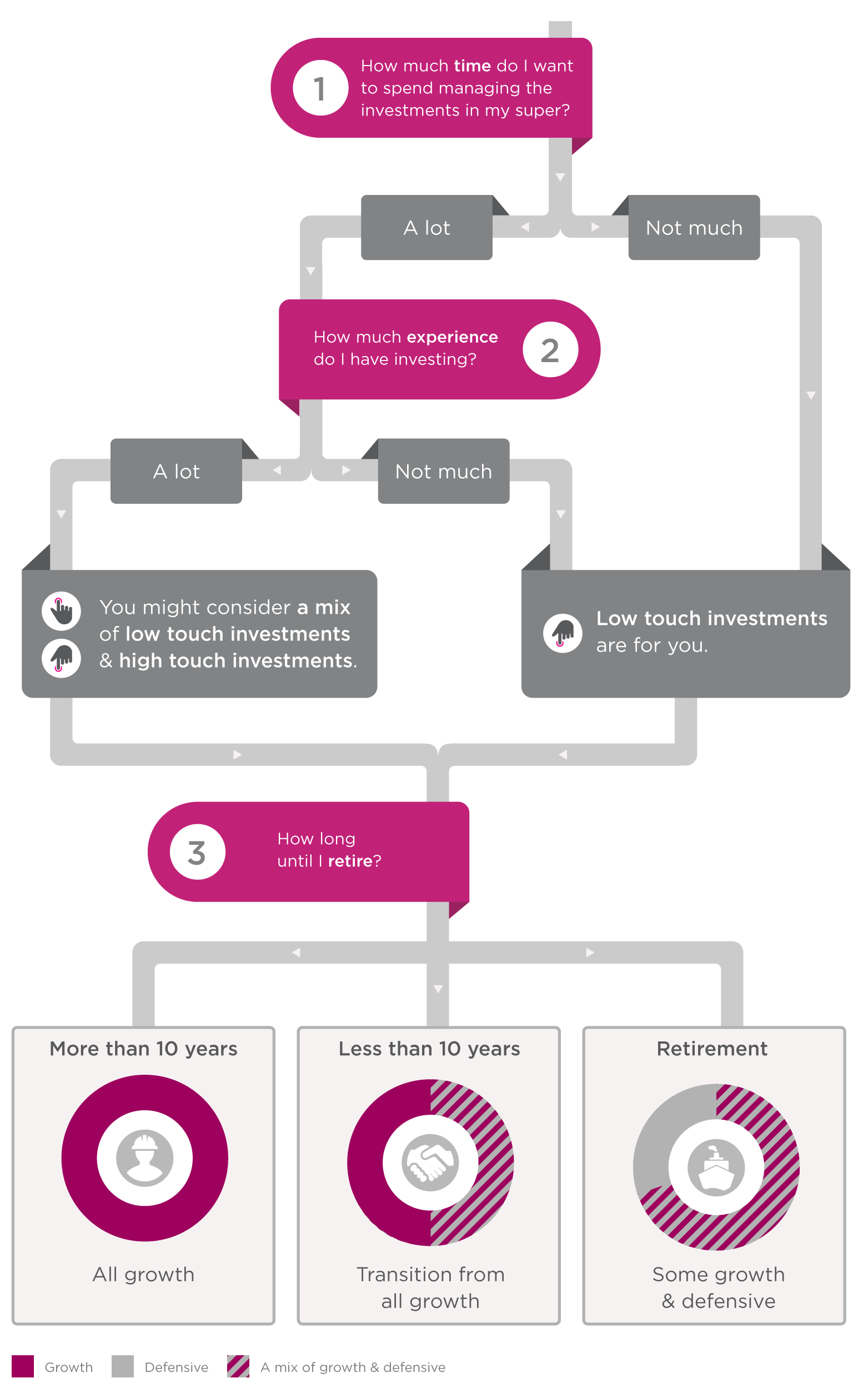

When you decide which assets to invest in, you risk being in the wrong mix of growth or defensive investments (known as asset allocation risk). Our view is that this is best managed by matching the mix of growth and defensive assets to your stage of life.

Good growth investments will increase in value over the long term, but typically experience ups and downs along the way. This is fine if you have many years more in the workforce, but not so good if you need to get money out at short notice or are relying on it for income.

The flipside is also true. Good defensive investments will produce stable income, but that is of no use early in your career when you cannot access the income. What you need then is long-term growth.

Individual investment risk is the potential of losing your money in any one particular investment. The worst-case scenario is the total loss of the money you invested.

The way to manage individual investment risk is by never investing more than you are willing to lose in any one growth investment, and making sure that you spread the risk around by investing in lots of different things.

You can do this by getting someone else to do it for you (a low touch investment) or by choosing lots of them yourself and managing them yourself (high touch investments).

It is worth noting that when you use a low touch investment, that expert will normally invest your money in lot of individual investments. So your low touch investment is probably investing in various shares and asset classes and reducing the risk of any one of them going bad.

And if you invest in lots of low touch investments, you are further reducing the risk.

Three questions

Well done!

Well done!

Now you know what type of investor you are. You know whether you are looking for low or high touch investments or both, and you know if you are looking for growth or defensive investments or both. This may well change over time as your knowledge grows and as you get older, but it is the right place for you to start right now.

To learn more about yourself as an investor, see the Portfolio Planner for ideas on what type of investments might be suitable for you and where you could invest your money.