Understanding ownership

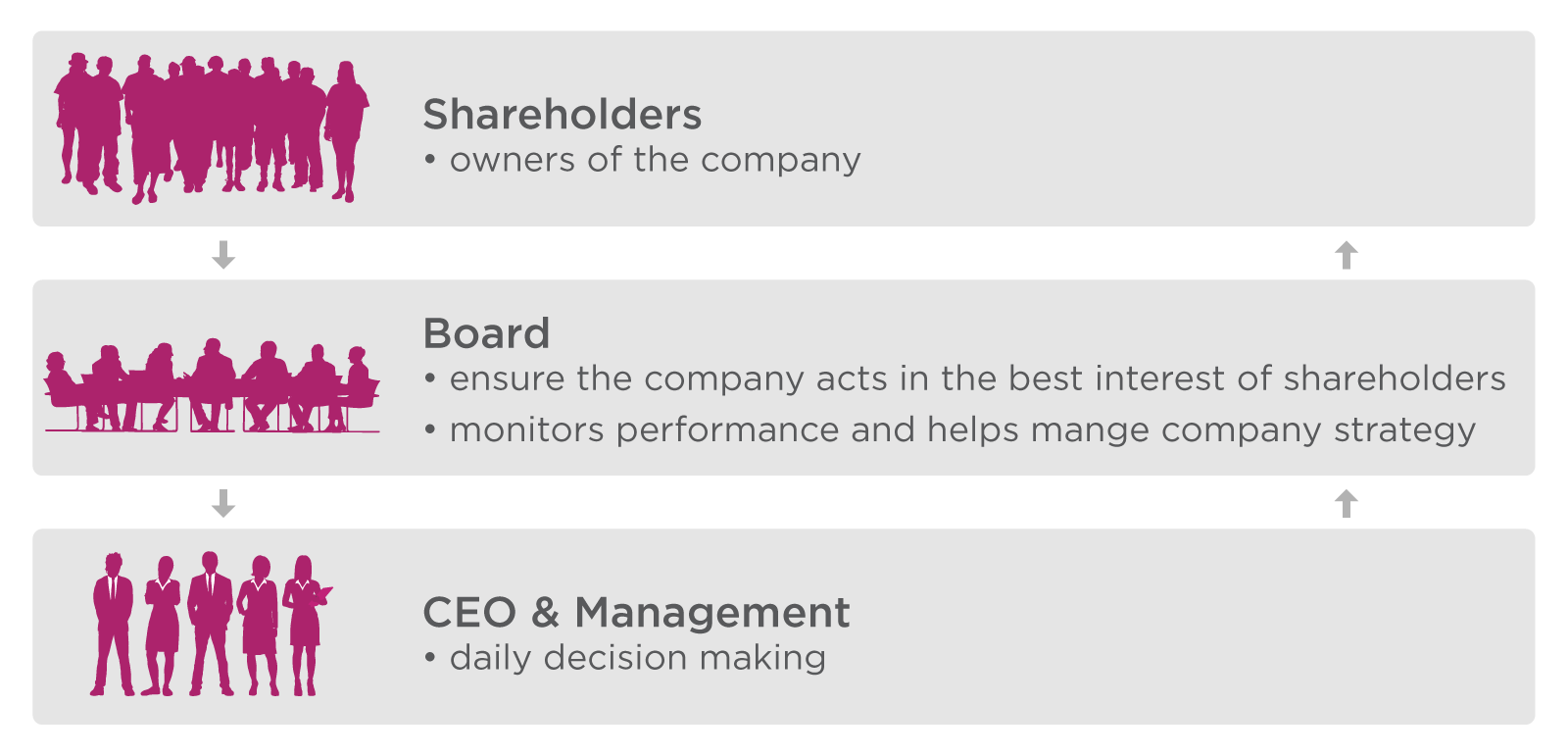

Shares are a snappy way of describing the ownership of a public company, like Woolworths or Google. They are also known as stocks or equities. Investing in shares makes you a shareholder - a part-owner - of that company. Luckily though, you are spared the responsibility of actually running the company or working for them.

Why would I own shares?

Shares can grow your savings when their prices move higher and dividends are paid - or the reverse if prices fall.

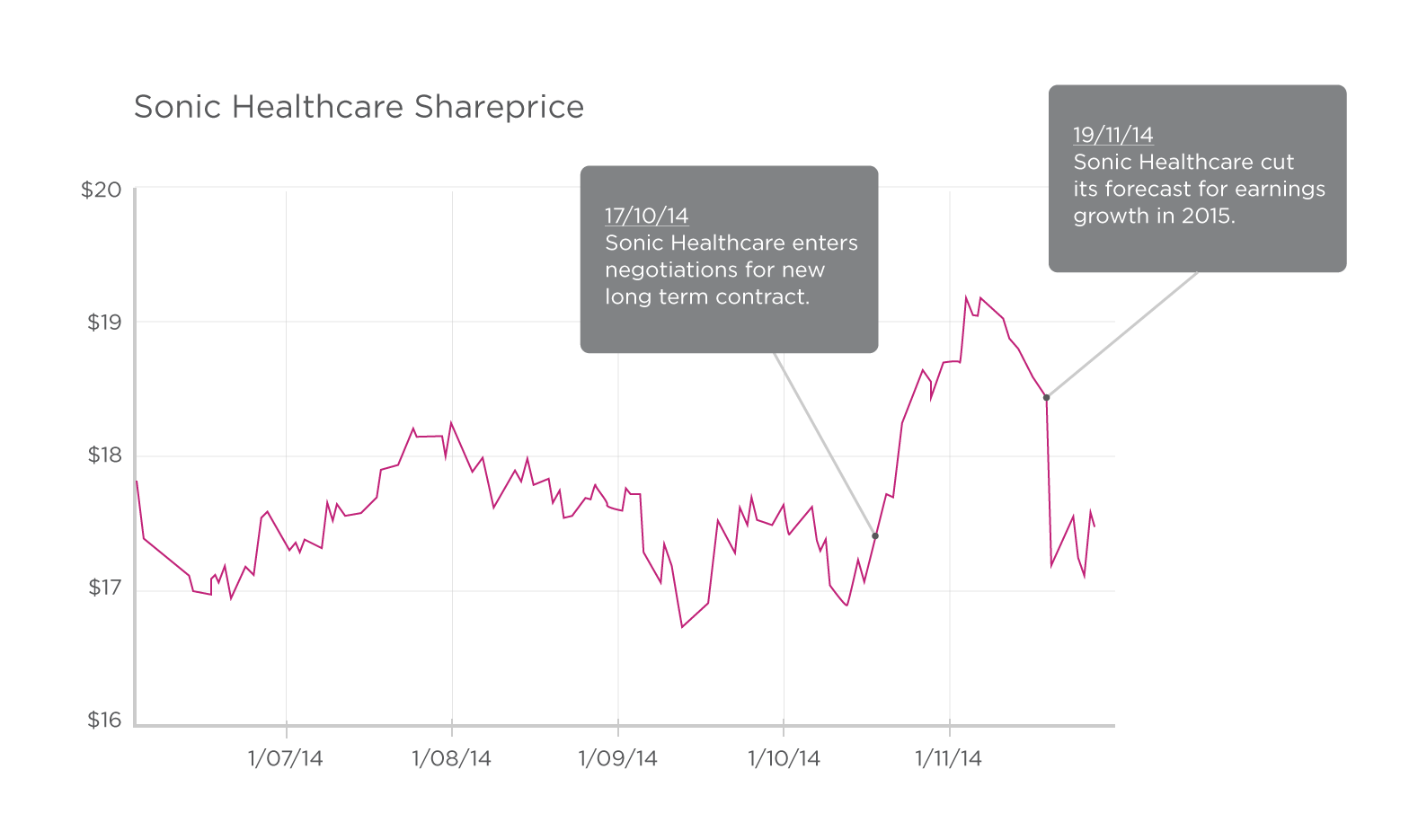

So how do share prices move higher? Generally it comes down to profits and expected future profits. The likelihood of greater profit in the future generally increases the value of the company today. In literal financial terms, the value of any company today is the value of its future profits in today's dollars. If there is a strong chance of a company turning a record profit in the next financial year, investors are going to get on board now, which in turn drives the shareprice up. Investors like consistent or increasing profits. It's therefore not surprising that on the flipside, events like profit warnings or downgrades, or anything that might reduce future profitability, can drive shareprices lower.

Many companies pay dividends from their profits, allowing their shareholders to immediately benefit from their profitability. Shareholders can receive these dividends either in cash or as additional shares if that company offers them as part of a dividend reinvestment plan. Many investors use dividends as an extra source of income. Sometimes the prospect of future dividends alone can also move share prices higher as investors are willing to pay a higher price for the dollar value of future dividends on offer.

Expectations

It is normal for share prices to move around a little bit, generally less than one per cent each day. But sometimes there are bigger price movements prompted by an announcement from the company. If big news or a particular announcement is expected by the market it might have little impact on the share price. However if something isn't expected, whether it's positive or negative news, it can result in a sharp movement in the share price.

Announcements don't only include financial information. Companies often brief the market, and analysts, about matters like the future direction of the business or key staff updates. This can cause share prices to change based on the expectations already built into prices.

The impact of announcements can be seen by looking at Sonc Healthcare's shareprice in the second hald of 2014.

Aside from all of this company-specific stuff, the price of shares is also affected by something much more intangible: mood. Even if the mood has no direct impact on the performance of a company, it can still affect its price. General market sentiment, which is really just about how confident or worried investors feel at any one time, is shaped by larger economic and geo-political factors. These can include war, disasters, interest rates, unemployment levels and simply whether people in different countries feel more like spending or more like saving.

How to own shares

Buyers and sellers set the price for each share every business day, trading through a central marketplace known as a stock exchange. You can buy and sell shares through an online broker or platform, like brightday, which links up to the stock exchange. Some investors also seek out an advisor to assist with recommending the shares who then execute the transactions on their behalf. If you reckon you can pick the shares on your own, off you go. Direct share investment for you is as simple as deciding what you want to buy - and sell - and having the funds available to do so.

There is no need to worry if you don't have the time or even interest to think about buying shares individually; this doesn't mean you can't own them. In this case, a low touch investment which has a fund manager buying and selling individual shares is likely to work better for you.

Buying shares through brightday

Buying and selling shares through brightday is easy. If you are buying shares, you just need to detail the number of shares, and the maximum price you are willing to pay. It's similar when it comes to selling - just detail the number of shares and the lowest price you are willing to sell at.

You are asked to set a time limit for every order. This means stating how long you are prepared to wait for the shares to be bought or sold. (If you wait too long, the shareprice may move too high or too low for you.) You have the following three options;

- 'Good for day' - if your order isn't executed by the end of the day, it is removed from the system. This means you would need to place a new order the following day if you were still interested in buying or selling.

- 'Good for 30 days' - your order will remain in the system until it is executed for thirty days, unless you cancel it first.

- 'Set an expiry date' - you can nominate a date when you would like your order removed if it isn't executed.

The way brightday is set up means you can't buy shares unless you have cash available in your 'Cash Hub', which is your cash account that payment will come from. When it comes to selling, you can't sell shares you don't have. While these might seem obvious restrictions, it means you can't land yourself in any hot water if you enter in some numbers incorrectly.

Costs

The cost of buying and selling shares through brightday is 0.125 per cent, with a minimum of $24.95. Any trade up to $20,000 will cost you $24.95, with amounts greater than this incurring the per cent based fee of 0.125 per cent. So if you were buying $30,0000 worth of shares it would cost you $37.50 ($30,000 x 0.00125).