Funds in the form of fixed income

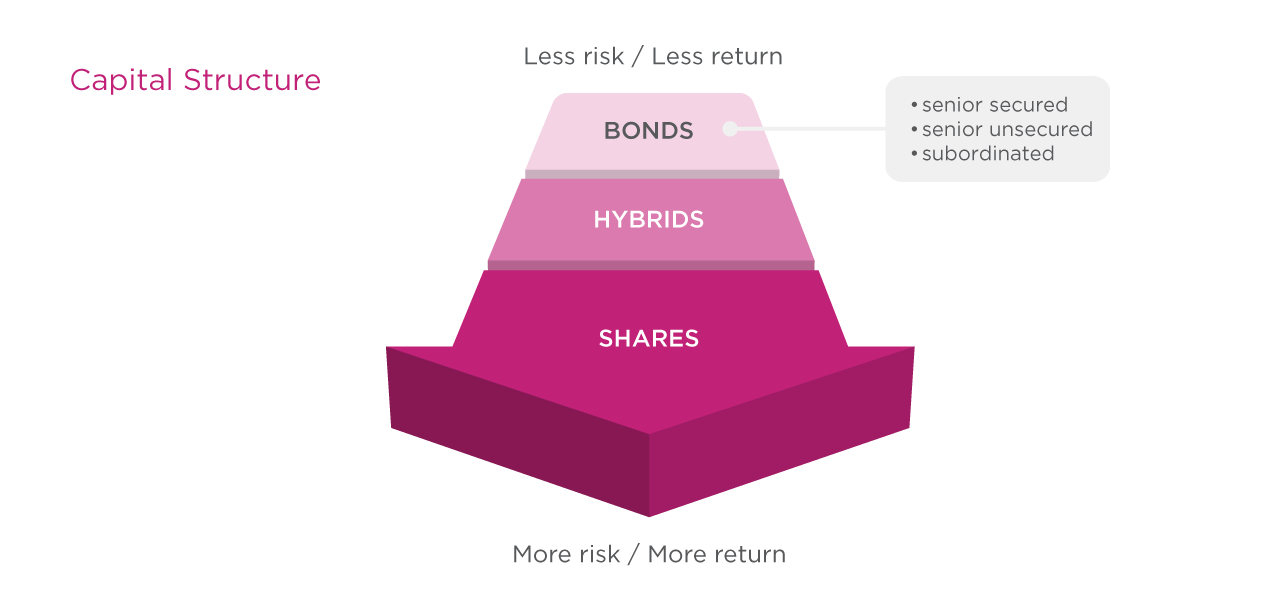

Putting your faith in a ‘sure thing’ can be an attractive prospect. While expecting complete certainty with any investment decision is naive, conservative lower-risk investments are popular and feature in most people’s portfolios. This can be in the form of cash, term deposits, bonds and managed investments.

For many super savers, holding high cash balances in the hope of attractive term deposit rates is no longer an option. And that means looking for other defensive investments that can keep the value of your savings relatively stable, but offer a higher rate of interest.

That’s where fixed income managed funds come in. Investors have been taking a cautious approach to them in recent times, and rightly so. During the GFC many of these funds were battered, shocking investors who thought they were 'safe as houses' investments. The good news is the lessons of the past give us a guide of what to look out for. Any time you hand over the decision-making to a fund manager, you should know what they invest in and what the risks are.

Here’s what to look for when reading through a fund’s product disclosure statement (PDS).

Investment grade

Investment grade debt issues generally have a low risk of default, meaning investors can expect to receive all of their interest payments and their principal back at maturity. You should review the PDS carefully to see if the fund manager has made clear the credit risks they have in their portfolio.

Non-investment grade

Non-investment grade debt can also be described as higher risk or junk bonds. With these securities there is an increased chance (compared to investment grade) that companies or even governments issuing the debt could miss a payment or might not be able to repay the amount they have borrowed (this is called ‘defaulting’).

Generally issuers of non-investment grade debt have to offer investors a higher rate of interest to reward them for the possibility of defaulting. While you are rewarded for the greater risk level, you are giving up some certainty over the preservation of your capital.

Note that syndicated loans and collateralised debt obligations are also types non-investment grade securities. You don’t need to know what these investment structures are, but you do need to know they come with more risk.

Non-investment grade risks can be mitigated if the fund manager has limits on the amount invested in any one company. This means even if there is default of one or two companies in a year, it might only account for a very small amount of the portfolio.

Risks of fixed income investments

When interest rates change, whether it be up or down, the value of bonds and in turn your investment are also affected. This is called interest rate risk. For example, a decrease of interest rates will increase the value of debt securities, but it can also reduce the dollar value of interest payments if it is a floating rate issue.

Credit risk is the possibility of not receiving all interest payments or the principal amount at maturity. When this happens the company is considered to be in default.

Why invest with a portfolio manager?

Buying debt securities isn’t as straightforward as buying shares. Aside from the fact buying individual bonds requires too much outlay for most investors, fixed income investments are highly sensitive to expectations about future interest rates. Also, some debt issues won’t be available to you as a retail investor since the entry amount can be as much as $500,000 or more.

Lastly, if purchased in overseas currencies, there is an exchange rate factor which may also play out, either in your favour or not. A portfolio manager, however, will often cover the currency exposure for you so you that don’t need to worry about it.