What is an SMSF?

An SMSF is a private fund that allows up to four members make all the investment decisions for their retirement savings. Like all other funds or trusts, an SMSF is a legal structure with very specific rules and needs to be set up and managed accordingly. SMSFs are attractive to many investors because they offer direct control of their retirement savings. Unlike traditional industry and retail super funds, the owner of an SMSF decides exactly how and where to invest. This is why it is the fastest growing sector of the super industry. And it’s not just the control that attracts people, an SMSF also offers more options when it comes to executing broader financial strategies (such as combining your funds with your partner’s) and estate planning.

Members and trustees

The common thread among all types of super funds is they all have members and trustees. If you’re thinking about establishing an SMSF, you need to understand what these words mean.

-

A member of a super fund either makes contributions or draws a pension from the fund.

-

A trustee is responsible for managing the fund, making investment decisions and following the fund rules.

The trustee of an industry or retail fund is generally a company set up to manage the retirement savings of the fund’s members. Generally the trustees of an SMSF are members, and have some or all of their retirement savings in the fund. So an SMSF differs from an industry or retail fund in that you are both a member and a trustee.

Trustees have responsibilities, which we explain in Trustee Responsibilities. As a trustee, the investment decisions are up to you. If you are unsure of how to go about making investment decisions or what investments might suit you best, read our introductory series on investing to help you work this out.

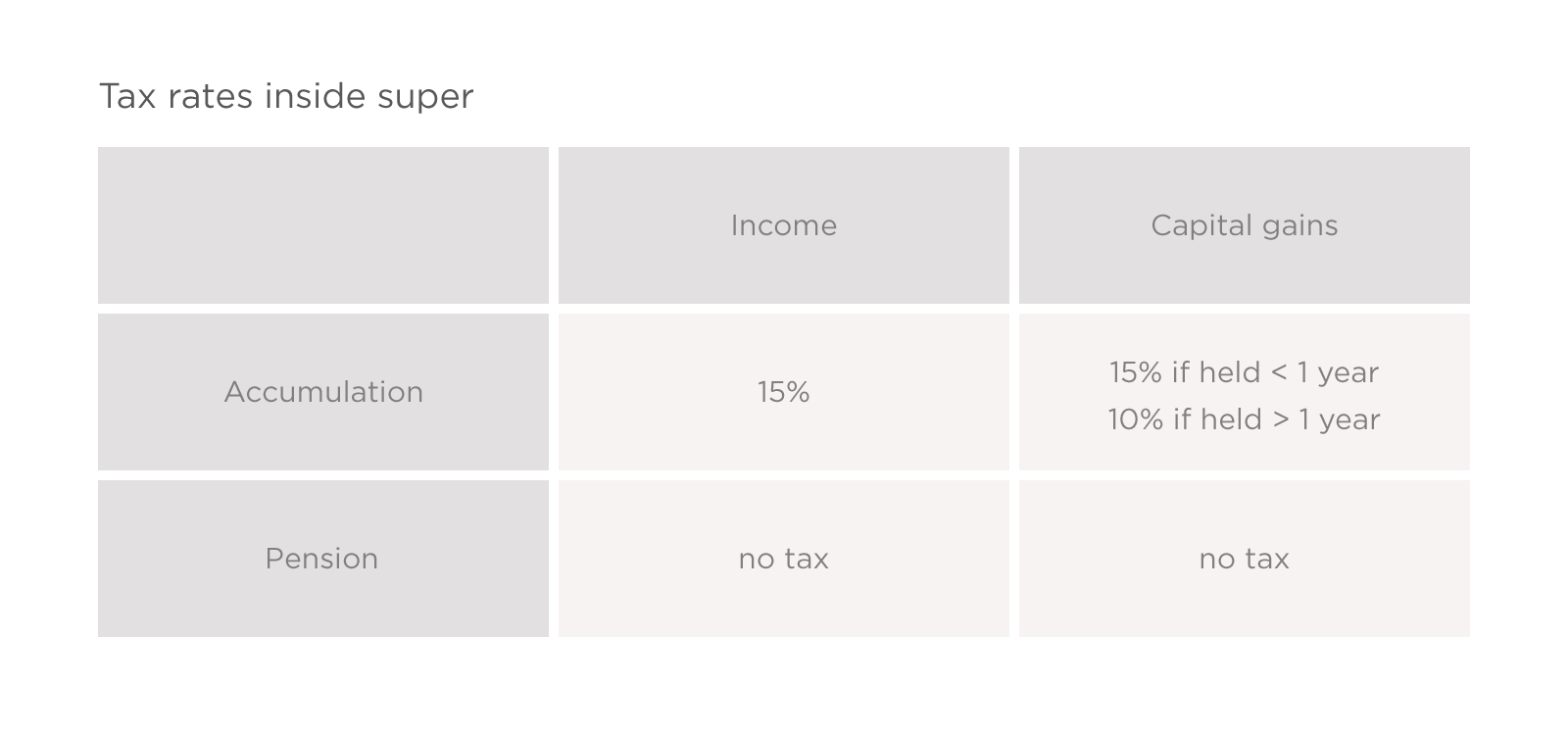

We pay different tax rates on our super earnings depending on whether we are still contributing or taking a pension. For this reason, our SMSF will either have an accumulation account responsible for receiving all of our contributions or a pension account to pay our pension from (or in some cases, it will have both).

Let’s refresh on the super tax rates:

Accumulation Accounts

Only an accumulation account can receive your contributions. Unless you are approaching retirement or retired, you will only have an accumulation account. You can withdraw a lump sum or take a series of payments from your accumulation account (providing you have met the condition of release). While this is allowed, if you have met your preservation age and plan to take regular withdrawals, you should open a separate pension account. You can then withdraw from this as it will reduce the tax paid on earnings of any funds in the pension account.

Pensions Accounts

To have a pension account, you must have reached either your preservation age, or be 65 or over. Once you have a pension account you are agreeing to take the minimum amount from your super each year. The minimum amount is set by the government. You can see the rates on the MoneySmart website. The favourable tax treatment of pension accounts is the reason many advisors often recommend that, once you are eligible to take a pension, you do so!

In an industry or retail super fund, you must have both an accumulation fund and pension fund if you are still putting money into super and also drawing a pension. This can only occur when you have met the minimum age requirement to access your super. You would also need to select investment options for both pools of your money.

However if you have an SMSF, you can accumulate and take a pension all under the umbrella of the one fund. This means you don’t need to select an investment option for accumulation and pension as these accounts only exist as an accounting entry - you still only have one pool of money to manage. The simplcity of having everything under the one umbrella means a transition to retirement pension is easily done with the one fund, as is a standard account based pension.

Paying tax

A lot of work goes into the accounting of an SMSF, which is one of the reasons why SMSFs are audited by the ATO.

The good bit about having an SMSF is tax is paid once you have lodged your tax return. (For the tax rates see the table above.) This means money can stay in your fund for much longer, earning interest or being invested. Industry and retail funds collect tax as contributions are made. Any capital gains will affect the unit price immediately, so there is no chance to have your taxed funds earning that little bit extra.