Get your portions right

While brightday vouches for the strategy of ensuring you are not holding on to too much cash for your stage of life, there are a few guidelines to follow with the cash you do have.

It’s good to invest in assets that will either grow your capital or provide a healthy income stream, but you should still have around three years worth of pensions available in cash (most importantly to be able to take the minimum pension amount you have to each year, which most people hold in an account-based pension).

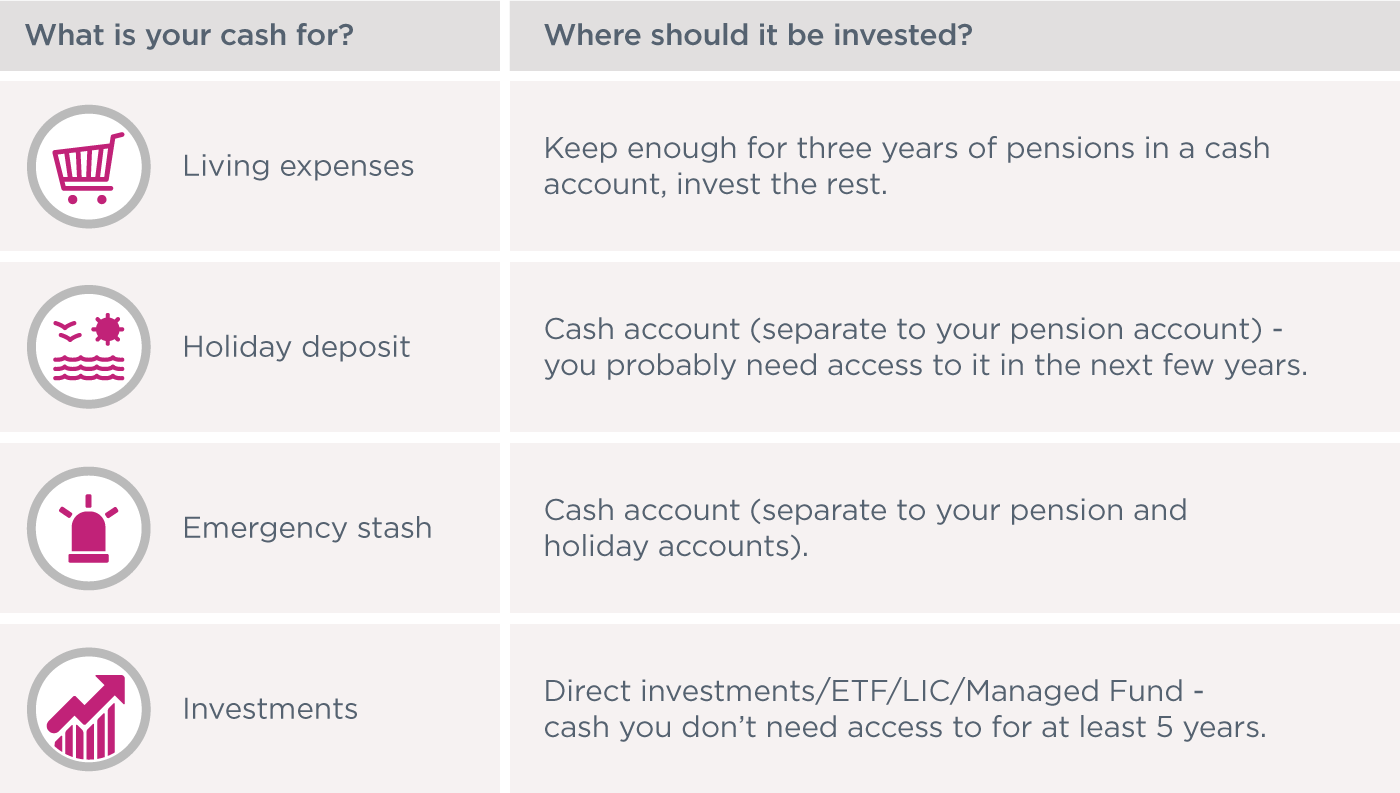

Have a look at the table below to see what cash you might have and where it should be invested.

As well as living expenses, set aside some cash in a separate account for a holiday or other big purchase you have planned, and have an account for ‘just in case’. It’s all about having easy access to your cash when you need.

To top up your cash account you might have to sell some assets, however you will hopefully be able to decide when this is, meaning you can avoid low points.