Movers and shakers

The star movers and shakers in Australia over the past year don’t include any of the largest dozen or so companies listed on the ASX.

But while there are no investor ‘favourites’ the list is made up of the brands you either use everyday or at least know of.

The brand names that have propelled some of the best performing companies on the ASX higher over the past year are: Dominos Pizza, Dotti, Smiggle and Peter Alexander, Donut King, Brumby’s Bakery, Crust, Transfield Services, Ramsay Healthcare and a range of poker machine games like 5 Dragons and Queen of the Nile.

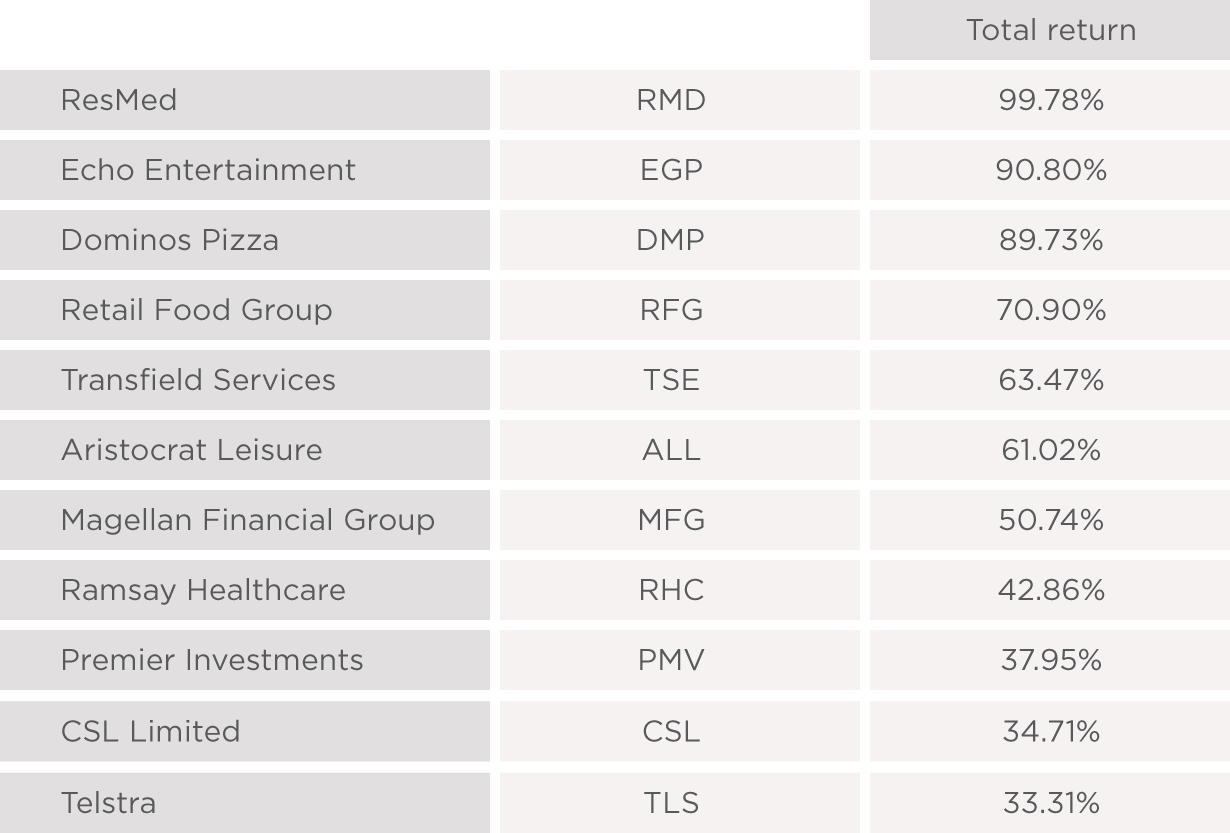

Source: Bloomberg. Data as at 31/3/2015

Above are the companies that own some of these brand names and their total return onver the year. Over the same time, the ASX 200 accumulation index returned 15.82 per cent.

CSL is the first company in the ASX 20 to get a mention and it comes in at number 51 on the list of highest total returners.

If you are invested in an ETF, or a broad based managed fund or listed investment company the chances are you only have a negligible amount invested in the types of smaller companies highlighted above.

Why you need to take note

The point of showing the returns of companies that span wider than the popular investment choices is as much about diversifying your Australian shares exposure by size of a company and the industry they operate in, to how smaller companies can add value to your portfolio.

Noting financials make up over 40 per cent of the ASX 200 index there isn’t much room for smaller companies to have a serious impact on the overall return of either the yardstick, or your portfolio.

Finding a manager

Investing in smaller companies is not for everyone. Unless you can navigate annual statements and have intimate knowledge of an industry it might be best to stick with a portfolio manager who has the time to know these companies back to front.

brightday’s Featured Funds includes some Australian fund managers who are experienced at investing in smaller companies and have the past performance to back them up.

How much to invest?

As with most things in life, there is a world of opportunity when it comes to the companies you can choose to invest in. But just how much you might invest in a fund manager or smaller companies in total is a personal decision.

You probably wouldn’t want to tip all of your Australian shares exposure into these types of fund managers, because smaller companies can have share prices that move from high to low more quickly than their more popular peers. So you need to decide on an amount you are comfortable with.

If you are completely satisfied with receiving a return in line with the market, this sector might not be for you. It’s possible a manager might underperform a particular benchmark.

Investing a portion of your portfolio with fund managers that don’t try and match the ASX 200 means you are diversifying where your returns come from. This in turn helps manage the risks your portfolio faces of being heavily reliant on the big 4 banks and other big names.