A how to

Working out where to invest your money when you join Complete Super or Complete Pension is as simple as selecting a box on the application form.

You can choose from among the six Ready-made Portfolios, or the Cash Hub, which you will need to select if you want to invest in managed funds, separately managed accounts (SMAs), direct shares and term deposits.

You need to specify how much you want to invest in the option you have selected. Let’s take a look at a few examples;

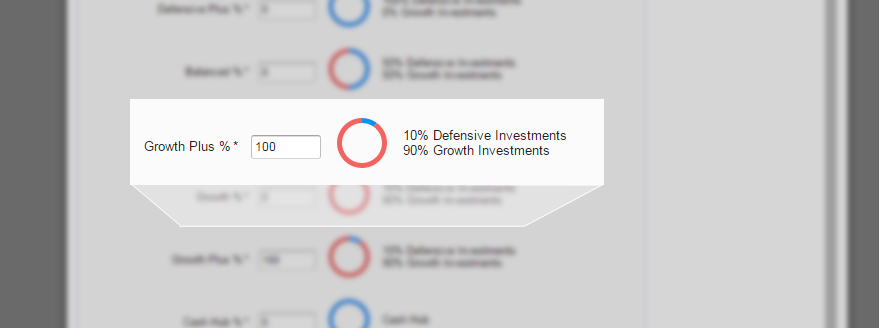

Michelle is 38 and wants to control her super, but doesn’t have the time or confidence just yet to make a bunch of decisions. So Michelle is putting 100% into Ready-made Growth Plus.

If you know you want to invest in direct shares or managed funds eventually but are not quite ready, you might do what Michelle has done. Then once you have decided what you want to invest in, you can sell some of your Ready-made option and buy the managed funds you have chosen. It’s easy to get started and you can move at your own pace moving forward.

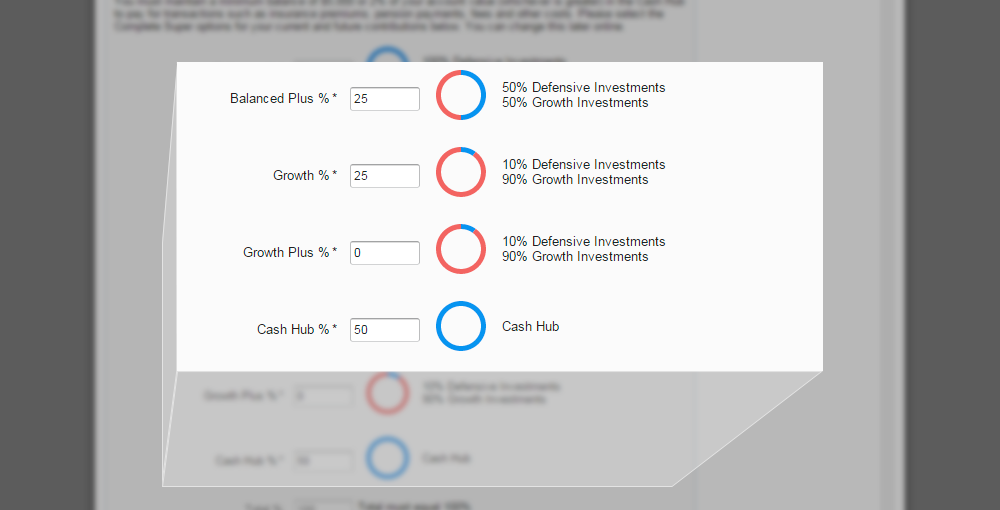

Bryce is 53 and has already picked a handful of managed funds to invest in. He is putting 25 per cent of his portfolio into Ready-made balanced plus, 25% into the Ready-made growth and the other half will go into the cash hub so he has funds available to buy his chosen managed funds.

Getting started is as simple as ticking a box and working how much of your money you would like to invest in this particular option.