The nitty gritty of super

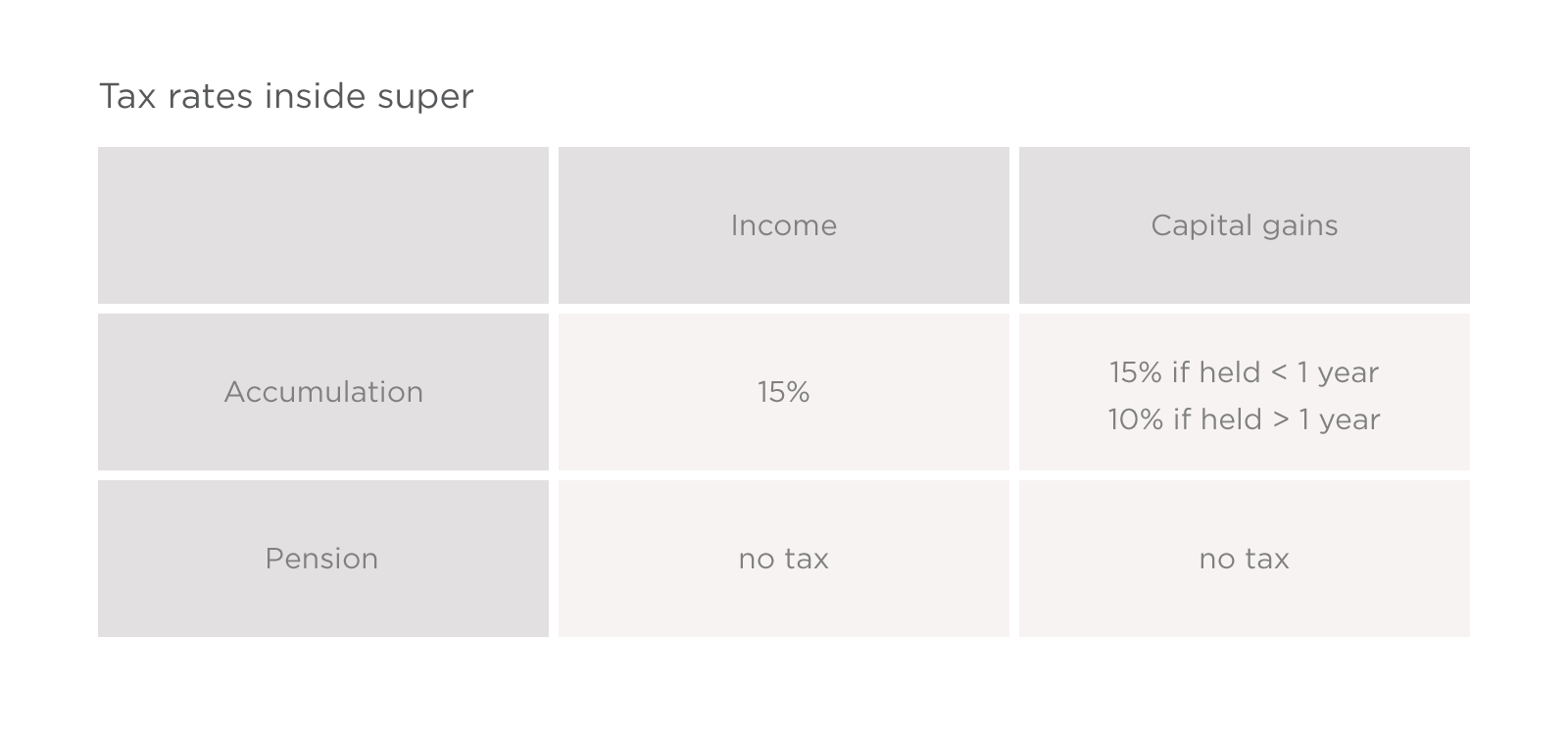

Super is the most tax effective way to save for and fund your retirement due to the lower tax rates offered compared to the tax rates applied to our ordinary income. To be able to take advantage of these tax rates, you need to understand how they work and what you can do to make the most of them. You might not know it, but our contributions and earnings when we are still accumulating funds are taxed very differently to when we begin taking a pension.

To entice people to be more self sufficient in their retirement, once you start taking a pension and move your funds to a pension account you pay no tax on any capital gains or income in this account. It's the only time I can think of where we won't be taxed!

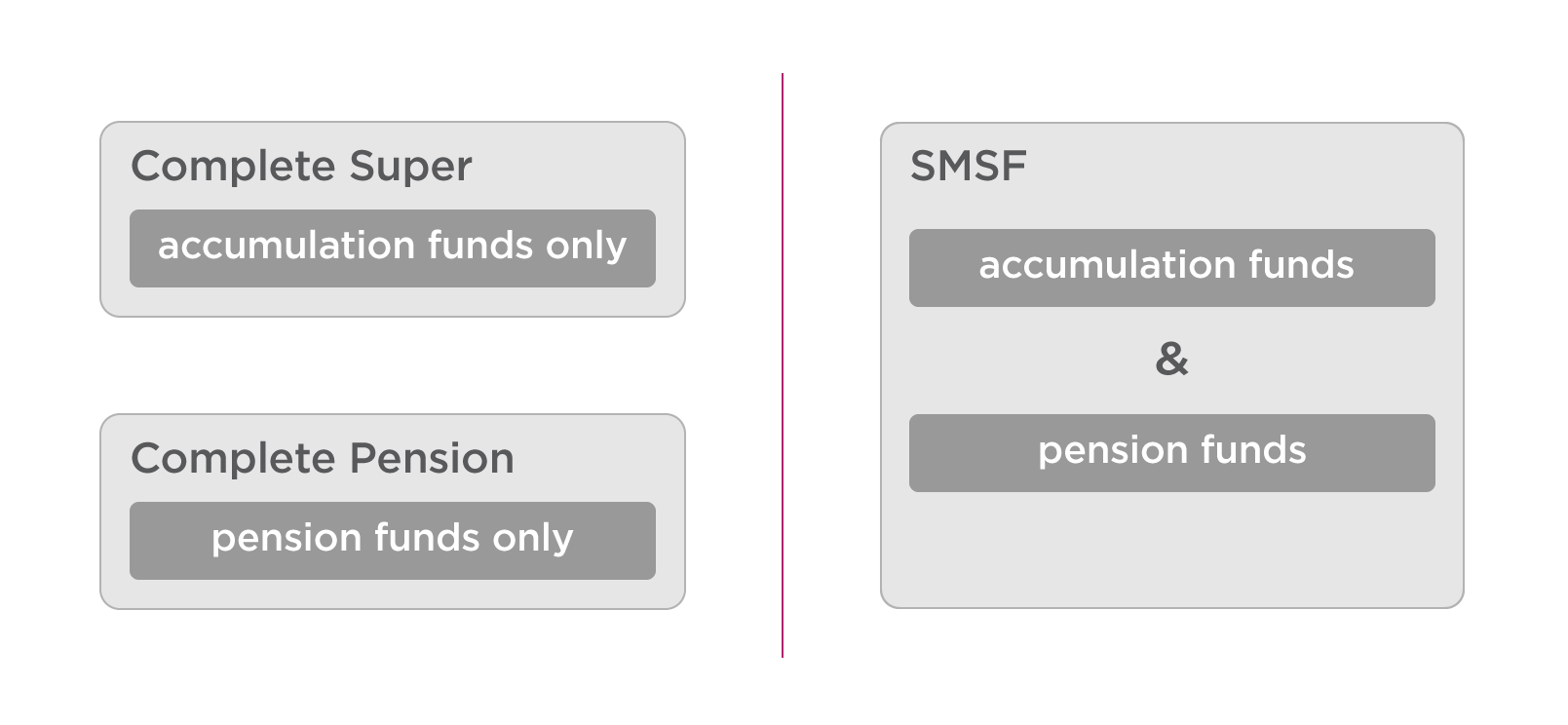

We can have both accumulation and pension accounts inside super. The reason why we have both of these accounts is because there are slightly different rules and tax rates that apply for each.

Income is both dividend and interest payments. Capital gains tax is paid upon the sale of investments with capital gains.

When is tax paid?

If you are using brightday's Complete Super you don't need to worry about paying tax as this is done on a cumulative basis. Complete Pension has no tax liability at all, as it's a pension fund and pays no tax on income or capital gains.

An SMSF however pays tax the same way we personally pay tax, which is at the end of the year. This means you can hang on to more money in your fund for longer. Ordinarily when you contribute into Complete Super, your 15 per cent contribution tax is immediately deducted. However, within an SMSF you don't have to pay contributions tax until you lodge your tax return.

Accumulation Accounts

If you're intending to add to your super, you can only make contributions to an accumulation account. In fact, unless you are approaching retirement or are retired, you will only have an accumulation account. While you can withdraw a lump sum or take a series of payments from your accumulation account (providing you have met a condition of release), if you are 55 or over you should open a separate pension account if you plan to take regular withdrawals. You can then withdraw from this as it will reduce the tax paid on earnings of any funds in the pension account.

The difference of 15 per cent tax might not sound like a lot, but it can add up! Say you are 60 with $300,000 in super and drawing the minimum pension of 4 per cent each year. Your fund earns a total income of $15,000 for the financial year, costing you $2,250 in tax. Add this up over five years and it can cost you over $11,000, even higher if you realise any capital gains during this period.

Pension Accounts

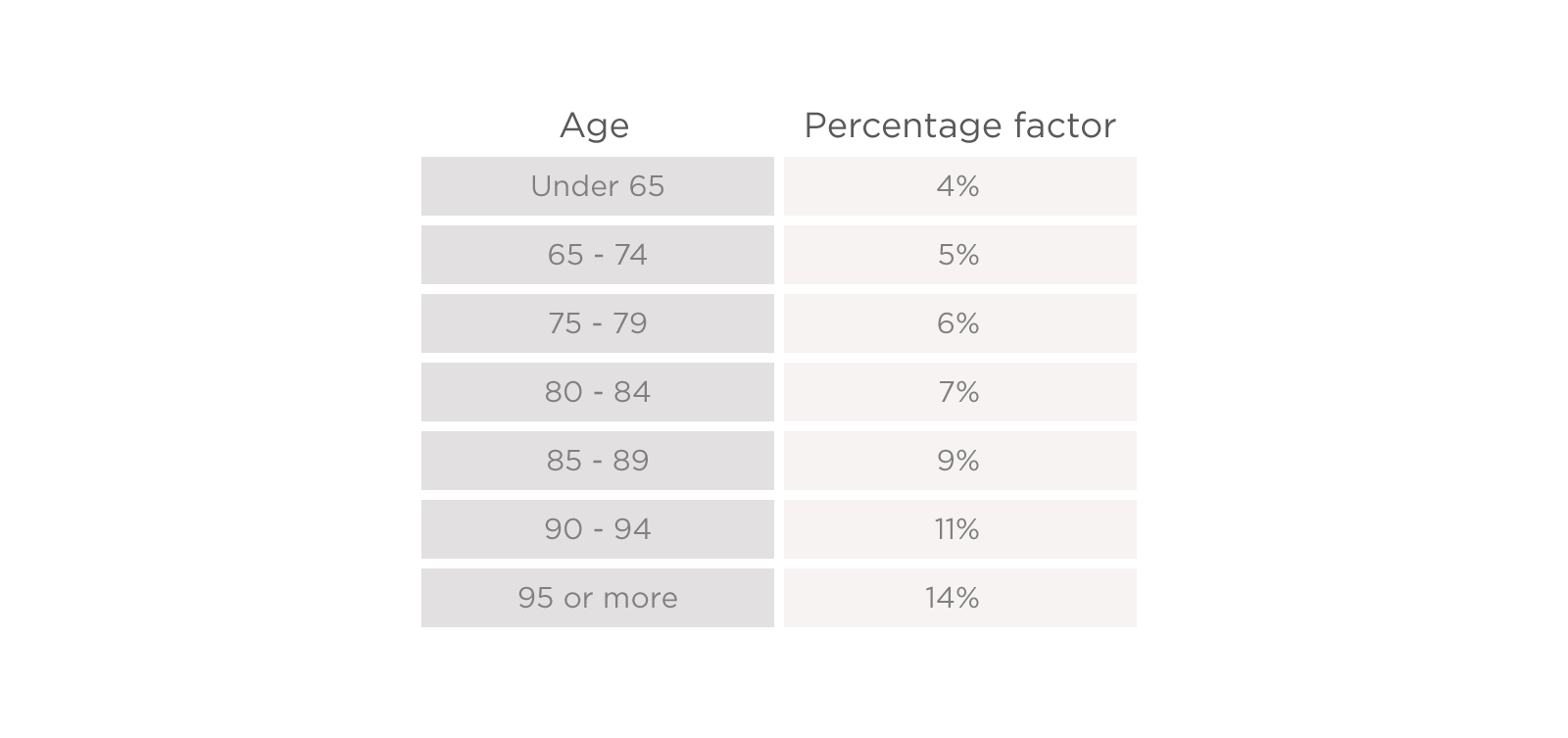

To have a pension account, you must have reached either your preservation age, or be 65 or over. Once you have a pension account you are effectively agreeing to take the minimum amount from your super each year. The minimum amount is set by the government. You're probably asking yourself now, why is there a minimum? The government want to encourage you to take funds from super. The favourable tax treatment of pension accounts is the reason many advisors often recommend once you are eligible to take a pension you do!

The minimum rates you're required to withdraw from your pension each year are as follows:

How do these work in my super?

Complete Super

Complete Super is an accumulation account only and must receive any contributions you make to your super if this is where your your retirement savings are invested. It can also fund a pension payment, but the tax rate of your Complete Super account won't change. If you can, you want to take a pension from your Complete Pension account so you can reduce the tax rates applied to your super.

Providing you are still eligible to contribute to super, you can still do this even when taking a pension. If you don't already have a Complete Super account, you will need to open one to receive your contribution. This means you would have both a Complete Super and Complete Pension account.

If you have Complete Pension, you must withdraw the minimum each financial year as outlined in the table above.

SMSF

With an SMSF you have a single fund that can have both an accumulation and pension account simultaneously. While an SMSF might seem complex on the surface, the features of it mean it can actually be easier for you to manage your super, especially as you approach retirement.