A change in strategy

How you manage your money once you hit retirement is different to what you would have done when you were growing your super. For starters, you actually need to have some cash in your portfolio as you need to take the minimum pension each year.

So just how much cash do you actually need? Somewhere around three years worth of pension payments you plan to take. Although you might not know how much you plan to spend, the government has set a minimum super withdrawal, which is a good place to start.

Keeping enough money available to cover a couple of years worth of withdrawals gives you the flexibility to weather stormy market conditions. It’s akin to having paid a bit extra off your mortgage in case you need to miss a payment or two.

The GFC was a painful reminder that asset prices and dividends can decline in value before we have time to think about it and prepare. Many self-funded retirees were caught out as asset prices were slashed in half and dividends fell to a fraction of what they once were. For many investors the cost was devastating as they were forced to sell assets at depressed prices to fund minimum pension withdrawals.

It should be noted the government did discount the amount you had to withdraw from your super fund to relieve some of the pressure on retirees. But there is no guarantee the concession would be afforded again if market conditions were unfavourable, similar to that of the GFC. And even if they were, you might need to take out as much as you can to fund your lifestyle.

What to do with income you receive?

The income you receive from shares and other investments can replace the amount cash you withdraw as a pension. If you’re fortunate enough to have a surplus - more income generated by your portfolio than you need to withdraw you can reinvest this amount.

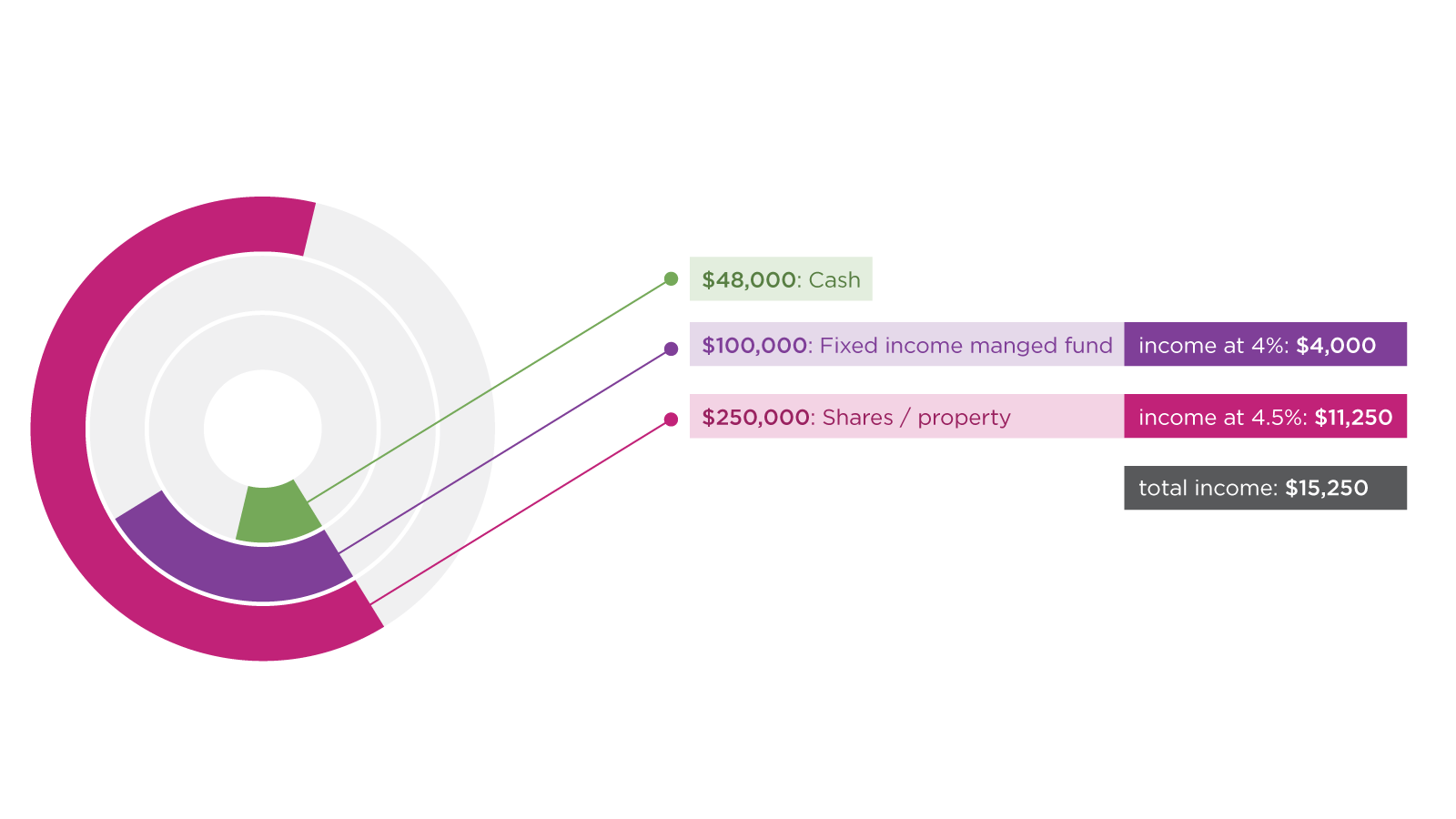

Marie is age 61, has $400,000 in her super and has just retired.

Minimum pension withdrawal this year: 4% x $400,000 = $16,000

This means Marie should ideally have $16,000 x 3 = $48,000 of cash in her fund.

Marie has invested her money as follows;

This means Marie will almost be taking a pension for the same amount of the income she generates. But if there is a year where income is much less she will be able to draw upon her cash reserves. This is particularly important because it means Marie doesn’t have to sell any investments to take her pension if asset prices fall.

This is a very basic example - it’s important to note the numbers in this example don’t include any capital growth from shares and property.

Being sensitive

Having a cash buffer means you aren’t so sensitive to a possible drop in dividend yield.

In Marie’s case, if the dividend yield dropped by 1 per cent it would mean $2,500 less in income. This would mean drawing on cash reserves to fund minimum withdrawals.

Taking more cash than you thought you might need, or if the income from your investments drops you will eventually need to top up your cash buffer. But having some cash on hand means you can choose when you do this instead of being a slave to prevailing market conditions.