Building towards an SMSF

For years we have heard that you need at least $200,000 to start your own SMSF, but this figure is no longer a line in the sand.

If you are in your late 30s or early 40s you might have close to the number, or be building towards it - even more so if you are thinking of combining your balance with your partner. You might even be younger - there are no clear-cut rules, as it is actually more around the cost of setting up and maintaining the fund versus other alternatives.

Why $200,000 anyway?

There are a number of reasons why having an SMSF can be beneficial, but you need to be comfortable with the fees you will pay, particularly if they are proportionately higher than staying with another type of fund.

You might be happy to wear higher costs because of the flexibility an SMSF can give you. Often people want control of their superannuation, or want to invest in property or an alternate asset class not available where they are. You might justify it by arguing that you could get a higher return than your current super fund if you had control over the investment decisions.

These are just a few points you might consider if you feel you don’t have a large enough balance to justify the costs of an SMSF relative to the asset value.

But there are limits to the amount most investors are prepared to pay to run their own SMSF. Few would accept fees of much more than 1 per cent of the funds invested.

For instance, in brightday’s Total SMSF option, if you have a $30,000 balance it would cost you a minimum of:

- Administration fee on assets: 0.005c for every $1, which is $150 a year;

- Administration and accounting fee: $990 a year.

So, that’s $1140, which is 3.8 per cent of the balance (and it also doesn’t include costs of establishment or other costs if you have property or loans). So, for a smaller balance like that having an SMSF isn’t a compelling super option in terms of cost.

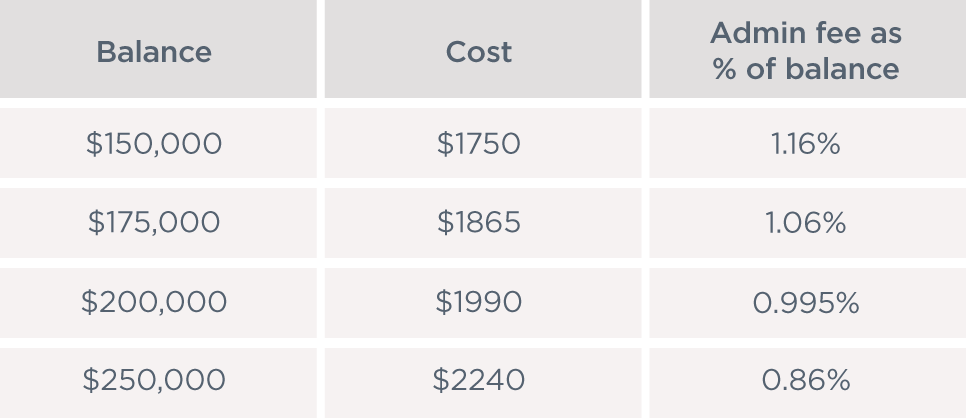

But the closer you get to $200,000 the smaller the fee. Here is how much it would cost with some larger balances in Total SMSF:

Note: those with smaller balances can still make some of their own investment decisions via a standard super option like Complete Super - it just has more limitations than an SMSF).

Closer than you think

What you need to think about when looking at the table above is how much you have now. You might find out that opening an SMSF is actually a lot closer than you think, for a number of reasons:

You are continually contributing to your fund

If you started the year with a balance of $150,000, remember that by the end of the year it is going to look much different.

For example’s sake let’s take a positive year on the sharemarket (which isn’t always the case).

John is 38 and has $160,000 in super. Earning $120,000 means John will have annual contributions of $9,690 (after super tax is paid). If his fund earns 8 per cent during the year he would finish the year with $180,000.

If you’re close to the $200,000 mark, think about the return you could achieve on the funds within your SMSF and the contributions you are making.

Also think about how much salary sacrificing might add. This figure would be even more if John was to salary sacrifice some of his paycheck each month.

Combining super

If you are in a couple, then it might be way closer than you think. You can look at the combined value of your super accounts.

For example, Chris & Maria have $130,000 in their accounts inside super. If they are both earning $80,000 they will be boosting their super balance by $13,000 each year (after super tax is paid) from contributions alone. The value of their contributions and fund returns could have them close to $200,000 within a couple of years. You can read about Angus Boyd's decision to have an SMSF here.

Why would you do it?

In this article this we have explained things couples need to think about before opting for an SMSF. Here are a few more questions to ask yourself:

- Do you want to invest in residential property?

- Do you have a high income and expect the balance will reach $200,000 in the near future?

- Are you close to retirement and considering how you can reduce costs?

- Do you want to combine super accounts with anyone (up to 4 people)?

If you answer yes to any of the above take a moment to to see what having an SMSF might allow you to do or how it might be more cost effective for you.